If you’re trying to choose between LifeLock and IDShield for identity theft protection, you’re probably wondering which service will best safeguard your personal information. You might also be considering which one offers the most value and meets your specific needs.

With identity theft and fraud on the rise, protecting your personal information is more important than ever. Cybercriminals are getting smarter and more aggressive, targeting both individuals and families. This comparison of LifeLock and IDShield will break down the core differences between these two leading services to help you make the best choice for you or your family.

We’ll test both services based on coverage, customer support, additional features, and overall value. Our thorough analysis will provide an unbiased perspective, giving you the information you need to make an informed decision. By the end of this comparison, you’ll have a clear understanding of what each service offers and which one is better suited for your digital security needs.

| LifeLock | IDShield | |

| Website | LifeLock.Norton.com | IDShield.com |

| Pricing | $7.50 – $32.99/month | $14.95 – $34.95/month |

| Money-back guarantee | 60 days | 30 days |

| 3-bureau credit monitoring | 1-bureau (Equifax) or 3-bureau (Experian, TransUnion, and Equifax) premium plans | 1 bureau (TransUnion) and 3 bureaus (Experian, TransUnion, and Equifax) with premium plans |

| 24/7 customer support | Yes | Yes (for urgent issues) |

| Identity theft insurance | Up to $3 million | Up to $3 million |

| Best deal | 52% Off Coupon > | N/A |

Key takeaways from LifeLock and IDShield comparison

LifeLock and IDShield offer up to $3 million in identity theft insurance, with LifeLock providing a tiered approach focusing on individual protection while IDShield offers comprehensive coverage including family plans.

IDShield emphasizes strong customer support with its responsive service and multi-factor authentication, while LifeLock combines its identity protection services with Norton antivirus for a more layered defense approach.

- Both services provide a 30-day trial, but LifeLock extends a 60-day money-back guarantee for annual plans, potentially attracting those looking for more assurance while evaluating identity theft protection services.

- In terms of value, LifeLock is the winner, especially if you use of this 52% off coupon.

How to select the right identity theft protection service: LifeLock vs IDShield

Before we delve into the specifics of LifeLock vs IDShield, let’s take a moment to outline the key criteria for selecting the ideal identity theft protection service:

Monitoring: LifeLock and IDShield do a great job of keeping an eye on your personal info. They monitor everything from public records to credit files and even the dark web to spot potential threats. This helps you catch any issues early on.

Protection: Beyond just monitoring, LifeLock and IDShield provide tools to keep your personal info safe. LifeLock teams up with Norton antivirus for more security, and IDShield uses multi-factor authentication and offers family plans. Both services also help remove your data from risky online sites.

Notifications: Quick alerts are essential for stopping identity fraud. LifeLock and IDShield both notify you of suspicious activity right away, helping you take swift action.

Resolution: If identity theft occurs, both LifeLock and IDShield offer dedicated support to help you through the resolution process. They provide up to $3 million in insurance to cover eligible expenses and losses, ensuring you have the financial support needed to recover.

Let’s swiftly break down the differences between LifeLock and IDShield to see which one fits your identity theft protection needs best.

LifeLock vs IDShield: Side-by-side comparison

Let’s put LifeLock and IDShield head-to-head in direct comparison to see which service might best suit your identity protection needs.

| LifeLock | IDShield | |

| Pricing | $7.50 – $32.99/month | $14.95-$34.95/month |

| Family-focused plans and features | Yes | Yes |

| 3-bureau credit monitoring and reports | 1-bureau (Equifax) or 3-bureau (Experian, TransUnion, and Equifax) | 1 bureau (TransUnion) and 3 bureaus (Experian, TransUnion, and Equifax) with premium plans |

| Dark web monitoring and alerts | Yes | Yes |

| Identity theft insurance | Up to $3 million | Up to $3 million |

| Social media account alerts | Yes | Yes |

| Credit lock | Yes | No |

| Lost wallet remediation | Yes | Yes |

| Antivirus and VPN | Yes but as an add-on for an extra fee | Yes (Trend Micro security suite) |

| Password manager | Yes | Yes |

| 24/7 customer support | Yes | Yes (for urgent issues) |

| Best deal | 52% Off Coupon > | N/A |

LifeLock vs IDShield: Which company is more trustworthy?

To judge the trustworthiness of identity theft protection services, examine their track record, user base, and industry standard adherence.

Now, let’s take a closer look at both of our contenders.

LifeLock overview

LifeLock, now under Gen Digital Inc. since shedding its Norton LifeLock identity in 2022, has been a prominent figure in identity theft prevention since 2005. Despite facing challenges such as a significant merger with Norton 360 and a $12 million FTC fine in 2010 for deceptive advertising claims, the company has persevered.

LifeLock has also seen its share of drama, such as the departure of co-founder Robert J. Maynard, Jr. under a cloud of controversy. But like a phoenix rising from the ashes, LifeLock has not only survived but evolved, boosting its services and security measures. This evolution includes the integration of comprehensive credit monitoring, dark web surveillance, and financial account safeguards, making it a formidable contender in the identity protection landscape.

Today, LifeLock maintains a robust Trustpilot score of 4.6, indicating a strong reputation among users. However, approximately 9% of reviewers have expressed dissatisfaction, awarding it the lowest rating. These critical voices point out issues with ID theft alert management, occasional technical problems, and less-than-ideal customer service experiences, including false alarms.

Despite these hiccups, LifeLock continues to innovate, offering additional digital defenses such as secure virtual private network (VPN) services and antivirus software through its partnership with Norton, thereby enhancing its layered defense approach.

LifeLock pros and cons

Now, it’s time to analyze the pros and cons that come with selecting LifeLock for your digital identity safeguarding:

+ Pros

30-day free trial period (recently added)

A VPN with family plans

Comprehensive identity theft protection service

- Can be combined with Norton 360 antivirus software

Up to $1 million insurance for certain costs incurred from identity theft

User-friendly interface and easy setup

Stolen wallet protection

Simple-to-use mobile apps

– Cons

- 3-bureau monitoring is available in higher-tier plans only

- Confusing paid plan structure

- Higher cost compared to some competitors

Let’s now shift our focus to IDShield.

IDShield overview

With over four decades of experience under its belt, IDShield, part of PPLSI’s legacy, offers monitoring for individuals and families, coupled with antivirus software and a VPN for enhanced security.

Developed by LegalShield, formerly Pre-Paid Legal, IDShield specializes in proactive identity theft protection and credit monitoring. LegalShield, now rebranded, introduced IDShield in 2011, expanding its mission of accessible legal and security services. Based in Oklahoma, IDShield operates under US jurisdiction, ensuring compliance with local regulations.

IDShield boasts a high customer satisfaction rating of 4.6 stars on Trustpilot. However, some users have raised concerns about the website’s usability and the lack of weekend live support. Customer service response times, particularly for resolving unexpected IRS notifications, have also been a point of contention.

Despite legal challenges in the past, including settlements and lawsuits, IDShield maintains a clean record with no known data breaches, indicating a commitment to securing your sensitive information.

IDShield pros and cons

Next, we’ll examine the strengths and weaknesses of IDShield when it comes to meeting your digital identity protection requirements:

+ Pros

Credit file and personal info web scanning

Instant misuse alerts on all plans

Identity theft recovery aid including lost wages

Credit monitoring with one or three bureaus

SSN tracking for unauthorized use

Dark web checks for personal data leaks

Financial account vigilance

Complimentary Trend Micro security suite (VPN, antivirus, and password manager)

Licensed private investigators for theft restoration

– Cons

Confusing and cumbersome setup

Basic plans cover only TransUnion

No discounts for yearly plans

Bare-bones password manager

Is LifeLock or IDShield more trustworthy?

IDShield’s thorough monitoring services, multi-factor authentication, and clear, privacy-focused approach set it apart from most services. However, LifeLock has made great progress in building trust. Both of these services have a good 4.6 rating on TrustPilot.

Trustworthiness winner: Tie

Availability and insurance coverage: Does LifeLock or IDShield offer more comprehensive protection?

Both LifeLock and IDShield offer solid coverage with up to $3 million in insurance to help customers recover from identity theft. IDShield provides a comprehensive solution for individuals and families, with individual plans covering up to $1 million and family plans offering an impressive $3 million in identity theft insurance. This financial safety net ensures you have a reliable ally if identity theft occurs.

LifeLock also provides identity theft insurance but with a twist. The $1 million coverage mainly covers costs for lawyers and experts, while reimbursement for stolen funds and personal expenses starts at $25,000, depending on the plan. This tiered approach offers flexibility but requires careful consideration to choose the right plan for your needs.

Additionally, LifeLock’s system supports both Windows and macOS, and its Norton Safe Web browser extension works with Google Chrome, Mozilla Firefox, and Microsoft Edge. Both services offer mobile apps for Android and iOS, making it easy to manage your protection on the go.

Availability and insurance coverage winner: Tie

Core identity protection capabilities: Who wins LifeLock and IDShield face-off?

Both LifeLock and IDShield are great at monitoring your identity, but they do so in different ways. To pick the right one for you, check out their features for protecting your identity, like credit checks, dark web monitoring, and bank account security.

To start, let’s check out their credit monitoring services.

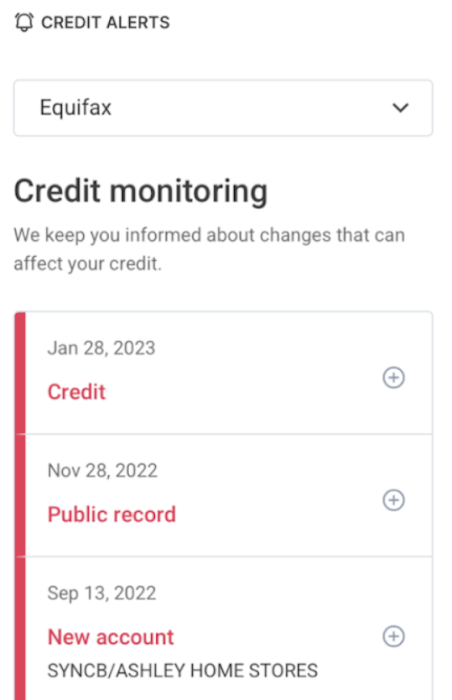

Credit monitoring across the bureaus

| LifeLock | IDShield | |

| Identity theft insurance amount | $1M with all plans but only for lawyers and experts. Stolen funds and personal expenses vary from $25,000 to $1M, depending on the plan | $1M in coverage for lawyers and experts. |

| Stolen funds reimbursement | Up to $3 million with the “Ultimate Plus” plan. Only $25,000 reimbursement with the “Standard” plan. | Up to $3M reimbursement for unrecovered costs |

LifeLock and IDShield both offer solid credit monitoring, but each has its own strengths. LifeLock gives you the option to choose between one-bureau or three-bureau credit monitoring, depending on your plan. With the “Ultimate” plus plan, you get the most comprehensive coverage, including monthly credit reports and daily credit-score updates from all three major bureaus.

One thing we really liked was the ability to lock and unlock your TransUnion credit file with just a click, making it easy to control who can check your credit when you’re applying for new credit or loans. However, the lower-tier plans are more basic, monitoring only one bureau and not including free credit reports, so you’d need to lock your Experian and Equifax files separately.

IDShield also gives you flexibility with single or three-bureau credit monitoring. Their service keeps a continuous watch on your credit reports from Equifax, Experian, and TransUnion, and alerts you to new credit applications, changes in payment history, and other important updates. We appreciated that everything is managed from a straightforward dashboard, but it’s worth noting that the basic plans cover only TransUnion, so you’ll need a more advanced plan for full coverage.

So, while both services do a great job, keep in mind that for comprehensive credit monitoring across all three bureaus, you’ll need to opt for a higher-tier plan.

Credit monitoring winner: Tie

Dark web surveillance

Exploring the dark web, both LifeLock and IDShield keep an eye out for any personal information breaches. With their comprehensive identity monitoring, including dark web surveillance, IDShield keeps us informed, while LifeLock works hard to secure our details from cybercriminals.

| LifeLock | IDShield | |

| What does Identity monitoring include? | Dark Web monitoring with public record monitoring and data breach notifications | Dark web monitoring with data breach alerts, SSN monitoring, social media reputation management |

| What can you add to your watchlist? | Your name, date of birth, address, email addresses, credit/debit card numbers, phone numbers, health insurance IDs, and more | Your account records, email addresses, phone numbers, SSN and driver’s license numbers, credit/debit card numbers, and more |

| You’ll receive alerts for any suspicious activity? | Yes | Yes |

LifeLock’s dark web surveillance is a standout feature. It actively searches the hidden parts of the internet for any misuse of our personal details. If LifeLock finds anything suspicious, it sends us an alert right away, so we can take action to protect our accounts. This proactive approach gives us an extra layer of defense.

IDShield also does a great job tracking the dark web, monitoring 15 types of personal data like email addresses, phone numbers, and credit cards. Their dark web scan tool looks for leaks of sensitive information. If our data is found, IDShield quickly alerts us, making sure even the most elusive threats are caught. This gives us peace of mind knowing our information is protected.

Dark web surveillance winner: Tie

Financial and investment account safeguards

When it comes to financial security, LifeLock stands out with its stolen funds reimbursement feature. Depending on the plan you choose, you get varying amounts of coverage. The Ultimate Plus plan is especially great, as it extends protection to bank and investment accounts, even covering 401(k) investments. With this plan, you’re covered for up to $1 million in identity theft-related losses, including personal expenses and legal costs. The lower-tier plans start with a $25,000 limit for stolen funds and personal expenses, increasing to $100,000 for the mid-tier plans.

IDShield, on the other hand, offers up to $3 million in insurance across all its plans, giving every subscriber a solid financial safety net. Individual plans provide up to $1 million in coverage, while family plans, which include monitoring across all three major credit bureaus, offer an impressive $3 million in identity theft insurance. This comprehensive coverage ensures that if identity theft ever happens, you’ve got a reliable ally to help mitigate the financial impact.

Account safeguards winner: IDShield

Restoration services rundown

Restoration services are the cavalry that comes to your rescue if your identity is stolen. IDShield stands out with a team of licensed private investigators ready to help you reclaim your stolen identity, backed by up to $1 million in restoration services.

LifeLock also provides robust restoration services, though details aren’t as prominently highlighted. However, IDShield’s personalized approach with dedicated investigators makes a noticeable difference in the support experience.

Restoration services winner: IDShield

Who offers superior core features: LifeLock or IDShield?

From our experience, IDShield really shines when it comes to core features. They offer comprehensive credit monitoring across all three major bureaus, extensive dark web surveillance, and up to $3 million in identity theft insurance across all their plans. It’s comforting to know that no matter which plan you choose, you’re getting top-notch protection.

Core identity protection capabilities winner: IDShield

Additional digital defenses: Who offers better extras?

In the arms race of digital security, LifeLock and IDShield do not shy away from equipping their subscribers with an arsenal of extra defenses. From secure VPN services to antivirus software, each service goes beyond identity monitoring to provide an extensive protective suite.

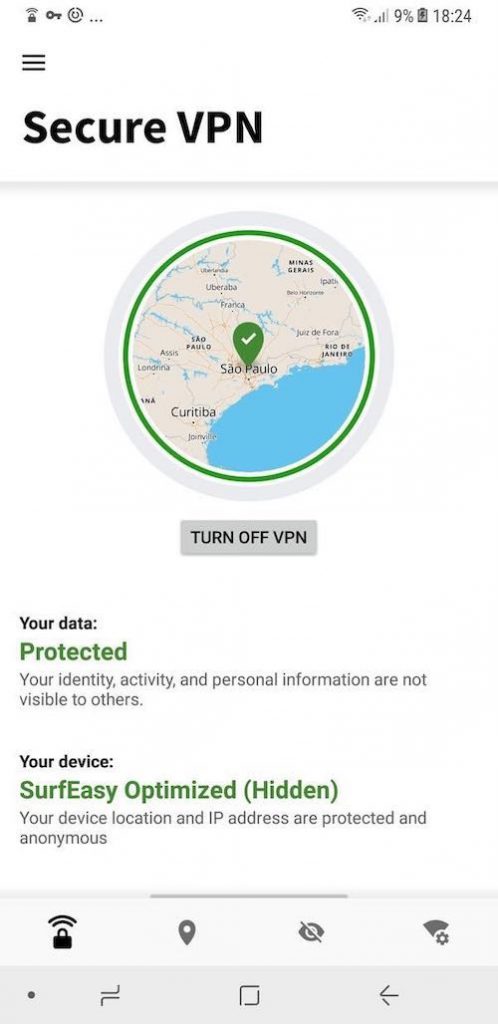

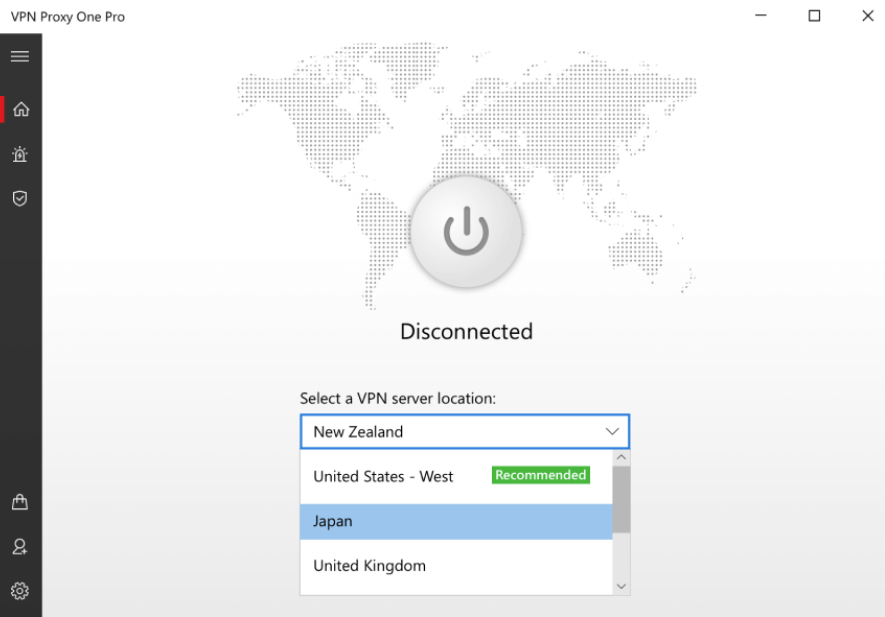

Secure VPN service

In an era where digital privacy is constantly under siege, a secure VPN service is crucial for safeguarding users’ online activities.

LifeLock’s VPN service includes features like a kill switch and split tunneling. Although it doesn’t come with Norton antivirus or VPN, you can pair LifeLock with Norton 360 for a stronger defense. Norton 360 offers proactive protection against malware and other online threats, along with a secure VPN for encrypted connections and private browsing.

IDShield partners with Trend Micro for its VPN service, providing encryption that secures data traffic on public Wi-Fi networks. It offers VPN Proxy One, supporting Windows 10 and 11, with a choice between WireGuard and OpenVPN protocols. WireGuard offers high-speed connections with advanced encryption, while OpenVPN balances security and performance.

However, IDShield’s VPN has limitations in content access due to a small server network and slower speeds, making it less ideal for streaming and high-bandwidth activities.

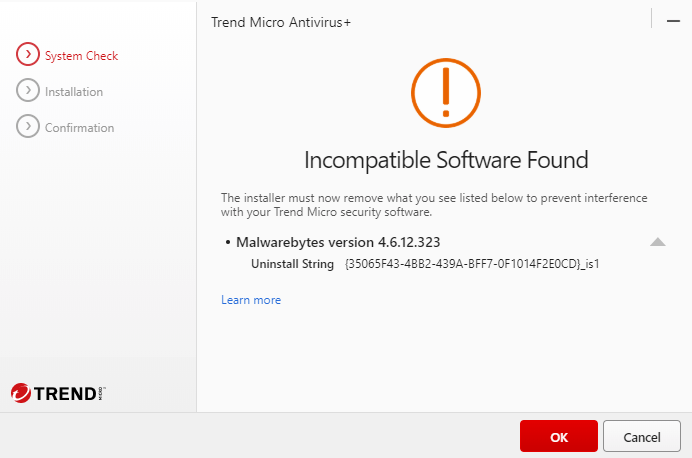

Antivirus software

Malware and ransomware can really mess up your digital life.

IDShield, partnering with Trend Micro, provides solid protection against these threats. This partnership ensures your devices are shielded from viruses, spyware, and phishing attacks, with real-time scanning and automatic updates to keep your defenses current.

LifeLock doesn’t have Norton antivirus software by default, but pairing it with Norton 360 offers superior protection. Norton 360 enhances security with real-time threat protection, a secure VPN for private browsing, and a password manager to keep your credentials safe.

We’ve found Norton’s anti-malware tools act as a vigilant shield, providing real-time protection against a wide range of threats like viruses, worms, trojans, and ransomware. Additionally, Norton 360 includes dark web monitoring, which alerts you if your personal information is found on the dark web, and a VPN that encrypts your online connections for added privacy.

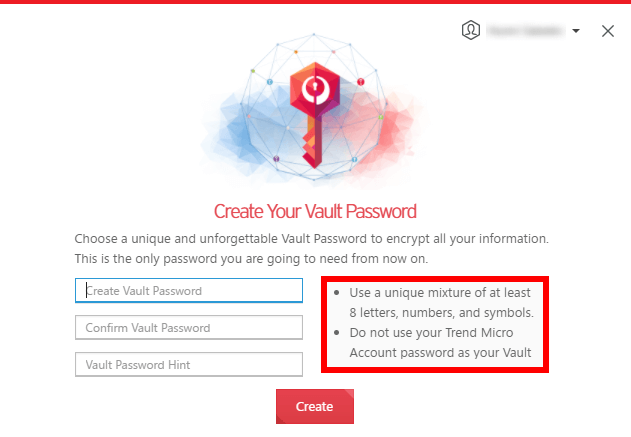

Password manager

IDShield’s password manager, powered by Trend Micro, is a handy tool for managing passwords across your devices, including Windows, macOS, Android, and iOS. It uses a strong master password to keep your stored credentials safe. However, when we tried it, we noticed it sometimes missed capturing login details and lacked features like secure password sharing or digital legacy options.

LifeLock doesn’t come with a password manager, but you can pair it with Norton 360 for added security. Norton 360’s password manager not only secures your logins but also creates complex passwords and encrypts your information. This combination offers a more thorough approach to managing and protecting your online credentials, making it a great addition to your digital security toolkit.

Parental controls and child safety

IDShield really steps up when it comes to protecting your kids from identity theft. It monitors their SSNs and personal info to catch any unauthorized use. If your child’s identity is compromised, they provide a private investigator to help restore it quickly and effectively.

LifeLock’s “Family” plan, on the other hand, offers a thorough approach to child identity protection. It actively monitors your children’s personal information and alerts you to any fraudulent activity. Plus, it includes robust parental controls and dark web scans to spot potential data leaks. If something does go wrong, LifeLock is quick to resolve the issue and offers stolen funds reimbursement, giving you peace of mind that your family’s financial safety is covered.

Both services have their strengths, but LifeLock’s comprehensive approach, including the added benefit of stolen funds reimbursement, makes it a strong contender for overall family protection.

Who offers better extra features?

After extensive testing, it’s clear that IDShield shines with its comprehensive protection suite, including a secure VPN, robust antivirus software, and a reliable password manager through Trend Micro.

Additional digital defenses winner: IDShield

Ease of use and support: Is LifeLock or IDShield more user-friendly?

Choosing the right identity theft protection service can feel like navigating a maze. LifeLock and IDShield each tout strong security features, but the real test lies in their user experience. As we dive into our comparison, we’ve taken these services for a spin to give you insights into which one offers smoother sailing on your journey to safeguarding your identity.

So, let’s roll up our sleeves and explore what sets them apart.

Setting up your protection

While LifeLock offers a user-friendly dashboard and guided setup process, IDShield’s initial setup may seem more complex, requiring navigation through multiple logins on third-party sites. However, once past the setup, IDShield’s interface is clear and straightforward, emphasizing the importance of a seamless user experience. With IDShield, enrolling typically takes just a few minutes, and you gain access to tools for monitoring personal information, credit files, and the dark web, all aimed at catching potential threats early.

Meanwhile, LifeLock’s setup involves providing essential personal information, adding accounts for monitoring, and completing the purchase process. Despite minor differences, both services prioritize making the setup process as hassle-free as possible, ensuring that your protection is up and running smoothly.

Navigating your apps

Our experience with IDShield’s mobile app has been positive overall. Despite occasional login issues reported by users, we found it easy to use and navigate. It provides essential features like dark web monitoring and credit score tracking, ensuring reliable on-the-go protection.

As for LifeLock’s mobile apps for Android and iOS, they simplify account management and provide instant alerts. While the availability of two separate apps may cause initial confusion, both offer user-friendly interfaces and robust functionalities like real-time alerts and dark web monitoring. Once logged in, managing your protection becomes effortless and intuitive.

Customer support and resources

Navigating customer support is easy with both IDShield and LifeLock. IDShield offers live chat, phone, email, and 24/7 emergency assistance, ensuring quick and helpful responses. We’ve found their live chat particularly useful, and their round-the-clock emergency support is reassuring for urgent situations.

LifeLock also offers 24/7 support via phone and live chat, although we’ve noticed their expertise sometimes leans towards Norton’s antivirus products. Despite this, their responsiveness and availability are commendable, with priority assistance for top-tier subscribers. While direct chat or email support isn’t readily available, LifeLock’s blog with articles and FAQs has been a helpful resource for resolving issues on our own.

So, which service is more user-friendly?

In the ease-of-use face-off, LifeLock emerges as the winner due to its user-friendly setup process and intuitive mobile apps, making it easy for users to navigate and manage their protection. While IDShield offers robust customer support and a clear interface post-setup, its initial complexity and occasional login issues slightly hinder the user experience.

Ease of use and support winner: LifeLock

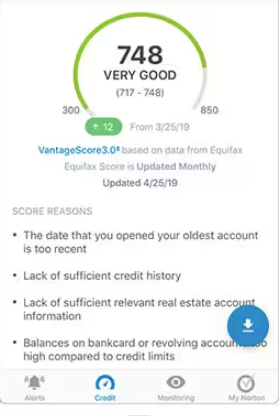

Financial health: Who offers more helpful credit reports and scores?

When it comes to keeping an eye on your financial health, having clear and useful credit reports and scores is a big deal.

LifeLock’s premium plan is pretty impressive, offering monthly credit reports and daily credit score updates from all three major credit reporting agencies. Plus, you can lock or unlock your TransUnion credit file, which is super handy when applying for new credit or loans. However, their lower-tier plans only give you basic monitoring with one credit bureau and might not include free credit reports. If you’re on one of these plans, you might need to freeze or lock your Experian and Equifax credit files on your own for full protection.

IDShield, however, makes things simpler. Every plan gives you access to credit information, starting with one-bureau monitoring through TransUnion and going up to comprehensive three-bureau monitoring. Their individual and family plans cover up to 10 children, offering solid protection for your whole family. Even if you start with just one-bureau monitoring, their broader plans provide thorough credit monitoring and alerts, making sure everyone is protected from potential identity theft threats.

Financial health winner: IDShield

Security and privacy: Is LifeLock or IDShield a safer choice?

When it comes to security and privacy, both LifeLock and IDShield have a lot to offer. Each provides up to $3 million in insurance coverage, but they approach things a bit differently. LifeLock tailors its services to individual needs, while IDShield takes a uniform approach across all plans, ensuring solid protection and privacy for everyone.

LifeLock has come a long way, tightening its security measures after past issues with the FTC. We’ve noticed these improvements and found them reassuring. IDShield, on the other hand, impressed us with its professional services and strict privacy policies. Both services use multi-factor authentication, which adds an extra layer of security to keep your data safe from unauthorized access.

One thing to keep in mind is that both LifeLock and IDShield might share personal information with third parties due to legal requirements. While they both offer strong identity protection, privacy-conscious users should be aware of this aspect.

Both LifeLock and IDShield use advanced encryption to protect your data. LifeLock uses strong encryption protocols to prevent data breaches, and IDShield employs AES 256-bit with TLS encryption. We appreciate that they both conduct regular security audits and offer helpful tips on maintaining personal data safety.

Overall, IDShield’s thorough and consistent approach to privacy and security makes it the better choice for those who prioritize these aspects.

Security and privacy winner: IDShield

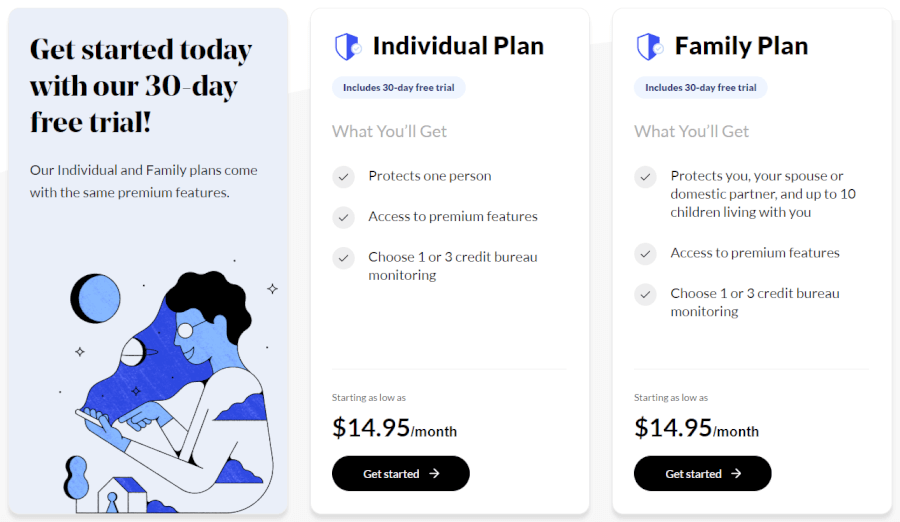

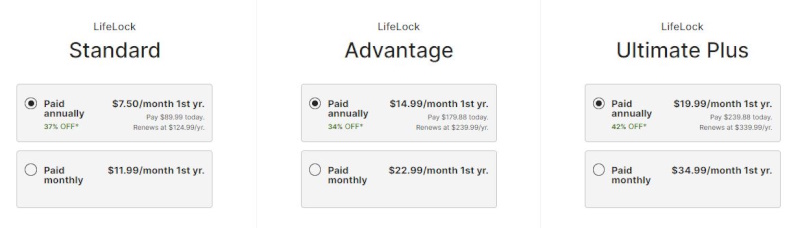

Plans and pricing: Does LifeLock or IDShield offer greater value for money?

Cost-effectiveness is a key factor when selecting an identity theft protection service. IDShield and LifeLock both have their unique pricing structures and features, but how do they stack up?

First, let’s take a look at IDShield. All of IDShield’s plans come with the same essential features. The only differences are the number of credit bureaus they monitor and whether you choose individual or family coverage:

Individual Plan (1-bureau monitoring) – $14.95/month: Includes credit file and personal info web scanning, instant misuse alerts, and access to licensed private investigators for theft restoration.

Individual Plan (3-bureau monitoring) – $19.95/month – Offers all the features of the one-bureau plan with the added benefit of monitoring across all three major credit bureaus.

Family Plan (1-bureau monitoring) – $24.95/month – Covers two adults and up to 10 dependent children with credit monitoring, dark web checks, and identity theft recovery aid.

Family Plan (3-bureau monitoring) – $34.95/month – Extends the family plan to include three-bureau monitoring for complete credit monitoring and protection.

IDShield’s transparent pricing ensures that customers are fully aware of what they are paying for, with no hidden charges or unexpected rate increases.

Meanwhile, LifeLock’s pricing plans are designed to meet a variety of needs and budgets, offering protection for both individuals and families. Here’s a simplified breakdown:

Standard: $7.50/month for the first year (then $12.49/month). Includes up to $25,000 in stolen funds reimbursement, $1 million for legal costs, and US-based identity restoration.

Advantage: $14.99/month for the first year (then $20.83/month). Offers up to $100,000 in stolen funds reimbursement and personal expense compensation, plus $1 million for legal costs.

Ultimate Plus: $19.99/month for the first year (then $29.15/month). Provides up to $1 million in stolen funds reimbursement and personal expenses, with three-bureau credit monitoring.

While the sheer number of plans can be overwhelming, they do offer comprehensive identity theft protection for families.

(opens in a new tab)”>See LifeLock’s latest prices and deals here >

While IDShield offers a 30-day free trial to test its identity protection services, LifeLock does not provide a free trial but compensates with a 60-day money-back guarantee on annual plans.

In the end, IDShield takes the crown in the plans and pricing round, thanks to its transparent and steady pricing model that shields customers from the sting of renewal rate hikes, ensuring a value-packed service without hidden costs.

Plans and pricing winner: IDShield

Conclusion: Who’s the clear winner?

When evaluating LifeLock and IDShield for identity protection, several key factors must be considered. Here’s a quick summary of how each service performs in the areas we reviewed:

Trustworthiness: Tie

Availability and insurance: Tie

Core identity protection capabilities: IDShield

Additional digital defenses: IDShield

Ease of use and support: LifeLock

Financial health reports: IDShield

Security and privacy: IDShield

Plans and pricing: IDShield

Ultimately, both LifeLock and IDShield offer robust and reputable services, but IDShield stands out for several reasons. Its inclusive feature set and family-friendly pricing make it a formidable choice, especially for those seeking comprehensive coverage without complexity. LifeLock’s varied plans cater to those who prefer customizable protection options and are willing to invest in specific features, offering a tailored shield for individual needs.

With IDShield, what you see is what you get, without any surprises in renewal prices – unlike LifeLock. This makes IDShield a solid choice, especially for budget-conscious users looking for straightforward, comprehensive protection.

Identity theft protection comparison guides on RestorePrivacy:

- Aura vs LifeLock

- Aura vs Experian IdentityWorks

- IDShield vs Aura

- Aura vs McAfee

- Aura vs Incogni

- Aura vs IdentityIQ

- Aura vs IDShield

- Identity Guard vs Aura

- Identity Guard vs LifeLock

- LifeLock vs Experian Identity Works

LifeLock vs IDShield FAQ

What are the main differences between LifeLock and IDShield?

LifeLock offers a variety of plans, each with different levels of coverage and features, including the added benefit of Norton antivirus. On the other hand, IDShield keeps it simple with straightforward pricing and comprehensive coverage across all their plans, including options for families. Plus, IDShield teams up with Trend Micro to provide robust VPN and antivirus protection.

What are the downsides of using LifeLock and IDShield?

LifeLock’s drawbacks include its complex pricing structure, higher costs, and limited credit bureau monitoring in the lower-tier plans. Some users have also experienced issues with alert management and customer service. On the other hand, IDShield’s setup process can be a bit cumbersome, and its basic plans only cover TransUnion. Additionally, the password manager offered by IDShield has limited features.

How do the credit monitoring features of LifeLock and IDShield differ?

LifeLock offers one-bureau or three-bureau credit monitoring with premium plans providing monthly credit reports and daily credit-score updates. Additional features include home title monitoring, VantageScore 3.0 access, stolen wallet protection, data breach monitoring, and payday loan monitoring.

IDShield monitors credit from one or all three bureaus and sends alerts for new credit applications or changes. It also provides VantageScore 3.0 access, stolen wallet protection, data breach monitoring, and payday loan monitoring, but lacks home title monitoring.

This LifeLock vs IDShield comparison guide was last updated on June 25, 2024.

Leave a Reply