If you’re considering Experian IdentityWorks for protecting your identity, you’ve come to the right place. Our in-depth review of IdentityWorks Identity Theft Protection will guide you through the essentials of keeping your personal information secure.

In today’s digital age, identity theft protection is no longer optional. It’s a critical service that defends against identity fraud, safeguards your financial health, and prevents your data from being misused for illegal activities.

Our team has carefully reviewed Experian’s identity theft solution – IdentityWorks – focusing on its credit monitoring, dark web surveillance, and alert systems. We must also note that considering Experian’s past data breaches and data-sharing practices, those who value privacy might think twice before signing up.

Key takeaways

- Experian IdentityWorks offers a variety of identity theft protection plans tailored to meet individual needs. These range from a no-cost plan featuring basic monitoring of your Experian credit report to premium options that provide comprehensive monitoring across all three major credit bureaus, vigilant surveillance of the dark web, and up to $1 million in identity theft insurance coverage.

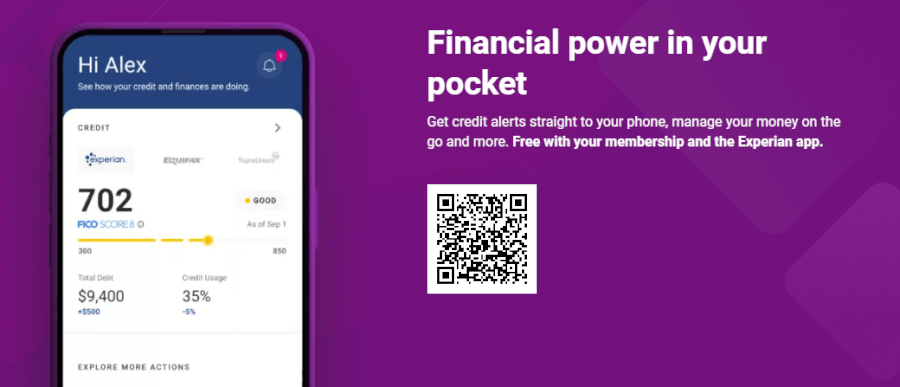

Standout features of IdentityWorks cover social media monitoring, a user-friendly mobile app for credit and identity management on the move, and a family plan that broadens protection to include adults and unlimited children within a household.

- Despite its extensive protection services, IdentityWorks has received criticism for its customer service efficiency, the higher costs of premium plans compared to competitors, and concerns regarding its data sharing practices.

- You can find the latest Experian prices and deals here.

Experian IdentityWorks pros and cons

Let’s dive into the advantages and drawbacks of opting for IdentityWorks:

+ Pros

A 7-day trial period

Enhanced alert system

Protection plans for individual users and families

Yearly payment discounts

Comprehensive credit monitoring across the three major credit bureaus

A permanent free plan with essential features

Mobile apps for iOS and Android

Identity theft insurance with paid subscriptions

Option to include another adult and up to 10 children in the family plan

– Cons

Limited to Experian credit reports in the basic plan

Pricier than some other options on the market

Potential sharing of user data with third parties for marketing purposes

Privacy concerns due to previous data breaches

No live chat support

Experian IdentityWorks feature summary

Let’s explore the array of features that IdentityWorks brings to the table:

Credit monitoring across all three major bureaus – Keeps an eye on your credit reports from Experian, Equifax, and TransUnion to promptly identify any suspicious changes that could indicate fraud.

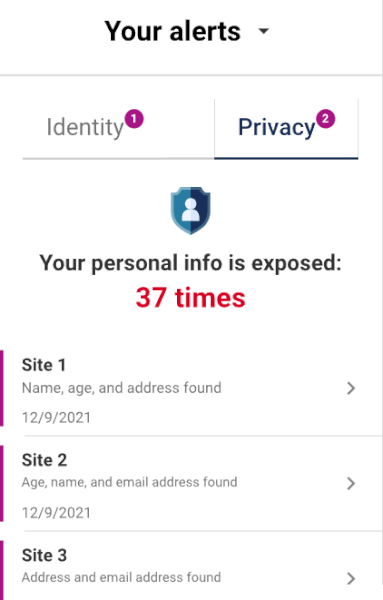

Dark web surveillance – Monitors the dark web for signs of your personal information being traded or misused.

Social media account alerts – Monitors your social media platforms for any unusual activity that could compromise your online identity.

Social Security number surveillance – Notifies you instantly if your unique Social Security number (SSN) is being misused, safeguarding your identity.

Child identity protection – The family plan option allows for up to 10 children, providing vigilant monitoring to keep your kids’ identities safe.

Lost wallet assistance – Offers support in canceling and reissuing cards and accounts if your wallet goes missing, helping to reduce the impact of the loss.

Address change monitoring – Alerts you to any unauthorized address changes filed with the USPS, which could be a sign of identity fraud.

Payday and non-credit loan alerts – Detects any quick cash loan applications made in your name, preventing fraudsters from exploiting your identity.

Court records scanning – This feature checks court records to make sure no crimes are falsely reported in your name.

Sex offender registry checks – Experian monitors sex offender registries across all 50 US states, providing notifications if your identity is mistakenly linked or if a sex offender is located near you.

- Free plan and free trial – You can cancel your membership anytime during the 7-day trial without incurring any charges. There’s also a free but basic plan with limited protection options.

What is Experian IdentityWorks and how it works?

Experian IdentityWorks is a comprehensive identity protection service, leveraging the expertise of its parent company, Experian, in the credit industry. Having tried it out, we found that Experian offers daily alerts to keep you in the loop about any changes in your credit and possible fraudulent activities. It’s a great way to stay on top of your Experian credit report.

The free plan provides basic credit monitoring and dark web surveillance. The “Plus” and “Premium” tiers offer enhanced security features, such as SSN alerts and family-focused plans. The Premium plan includes all-inclusive monitoring across all three credit bureaus, dark web surveillance, and identity theft support.

Company background: Can we trust Experian IdentityWorks?

Founded in 1996 and headquartered in Dublin, Ireland, Experian has come a long way from its early days as part of Credit Data Corporation. Today, it’s a global data analytics titan, keeping tabs on over a billion individuals and businesses worldwide. Known for its comprehensive credit insights on millions in the US, Experian is a key player among the “Big Three” credit-reporting agencies, along with TransUnion and Equifax.

Listed on the London Stock Exchange and part of the prestigious FTSE 100 Index, Experian has had its share of adventures and misadventures. It’s faced down the FTC over credit report sign-up disclosures and paid fines for credit score hiccups. But it’s also made savvy moves, like acquiring Clarity Services to deepen its data pool.

The “big three” data breach we need to talk about

When assessing Experian, a company specializing in credit reporting and identity protection, it’s essential to check its security history. Unfortunately, Experian’s data breaches have sparked serious security worries.

In October 2015, Experian announced a data breach that had persisted for two years, from September 2013 to September 2015, potentially compromising the personal information of up to 15 million individuals, including T-Mobile customers who had applied for credit checks.

In 2020, another breach occurred, this time affecting Experian’s operations in South Africa. Initially, Experian assured that the incident had been contained, but it was later revealed that the personal information of 24 million South Africans and nearly 800,000 businesses were exposed, including financial details for 24,838 entities.

The following year, in 2021, a leak was linked to Experian’s Brazilian subsidiary, Serasa Experian. Data from 220 million citizens, including deceased individuals, was sold online, encompassing names, social security numbers, income tax declaration forms, and addresses. Despite Experian’s claims of no evidence indicating their systems had been compromised, the leak was traced back to Serasa Experian.

After seeing all this, we can’t help but feel a shadow of doubt looming over the security of our personal information due to its history of data breaches.

Core Features: What do you get with Experian IdentityWorks?

Here’s a snapshot of what Experian IdentityWorks offers to guard your personal information:

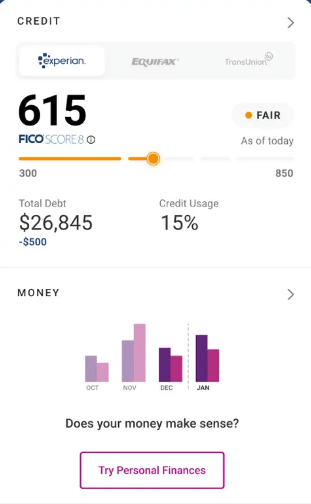

Credit monitoring across three national credit bureaus

Experian IdentityWorks provides vigilant credit monitoring services, keeping a watchful eye on your credit reports from Experian, TransUnion, and Equifax. This is crucial for spotting potential identity theft early by alerting you to any unauthorized inquiries or unfamiliar accounts that may appear.

Quick Tip: Wondering what makes a good credit score? Aim for a range between 881 and 960 for a solid rating. Scores falling between 721 and 880 are considered fair or average. Steering clear of anything below the average range helps maintain a strong financial standing.

With Experian’s deep expertise in credit data analysis, you can expect to receive timely updates about any unusual activities, helping to shield your financial identity from potential threats.

Dark web surveillance

Experian IdentityWorks keeps a watch over your personal details, promptly alerting you to any irregular activities that hint at identity theft. Alongside this, the service extends its protective reach into the depths of the dark web, ensuring that any unauthorized trading or misuse of your personal data doesn’t slip past unnoticed.

Fraud resolution and up to $1 million ID theft insurance

If you’re dealing with the challenges of identity theft, Experian IdentityWorks offers dedicated fraud resolution support to guide you through the recovery process smoothly and expertly.

For those who opt for the “Premium” or “Family” plans, there’s an additional layer of reassurance in the form of identity theft insurance, which provides up to $1 million in financial reimbursement to cover the losses and expenses incurred from such incidents.

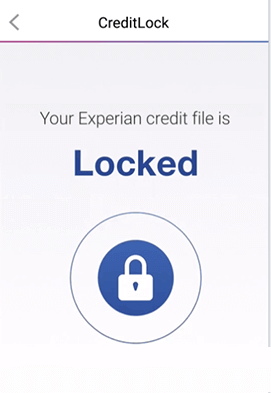

Experian CreditLock

An exclusive feature for subscribers is the Experian CreditLock. This tool gives you the easy ability to lock and unlock your Experian credit file whenever you need to, putting you in control of who can access your credit information.

We found it to be a simple yet effective way to boost our credit security, offering a strong defense against any unauthorized credit inquiries.

Some security extras

Experian IdentityWorks isn’t just about the basics. It also provides a suite of advanced security features to bolster its identity theft protection services:

Monthly privacy scans

Monthly privacy scans are a crucial part of Experian IdentityWorks’ offering. These scans search through covered people-finder databases to identify and help remove your personal information, reducing your exposure to potential identity theft and unwanted contact.

Social media monitoring

As our digital and real lives become increasingly intertwined, safeguarding our online presence is critical. IdentityWorks’ social media monitoring feature sends alerts to users when a social media post may put their identity or reputation at risk, ensuring that their online life remains private and secure.

Lost wallet protection

If your wallet goes missing, IdentityWorks steps in to ease the stress with its lost wallet assistance. They’ll guide you through the process of canceling and reissuing your credit and debit cards, which is a critical step in preventing fraudulent charges and protecting your identity.

This feature should save you time and spare you the hassle typically associated with lost or stolen wallets. While the service is generally effective, the speed of assistance and the response from financial institutions can influence its efficacy.

Ease of use: Is Experian IdentityWorks easy to use?

IdentityWorks shines with its user-friendly approach. Downloading and setting up the software is pretty straightforward, although it can take some time. Once installed, you’re practically all set. The system allows you to customize alerts and choose your preferred notification methods, while IdentityWorks manages the rest, ensuring a seamless experience for users.

Initial setup

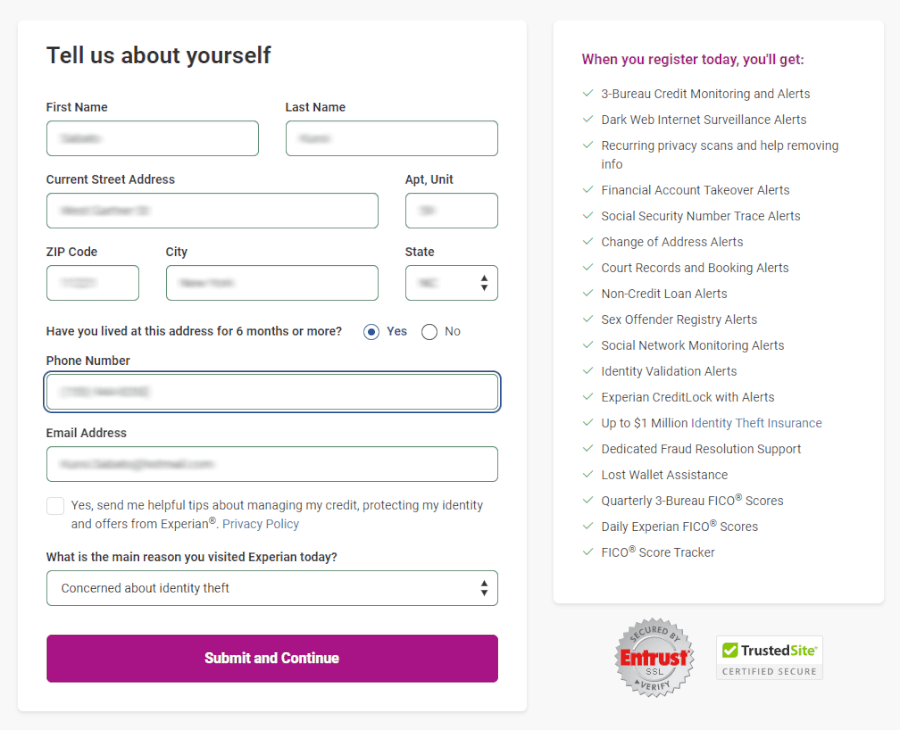

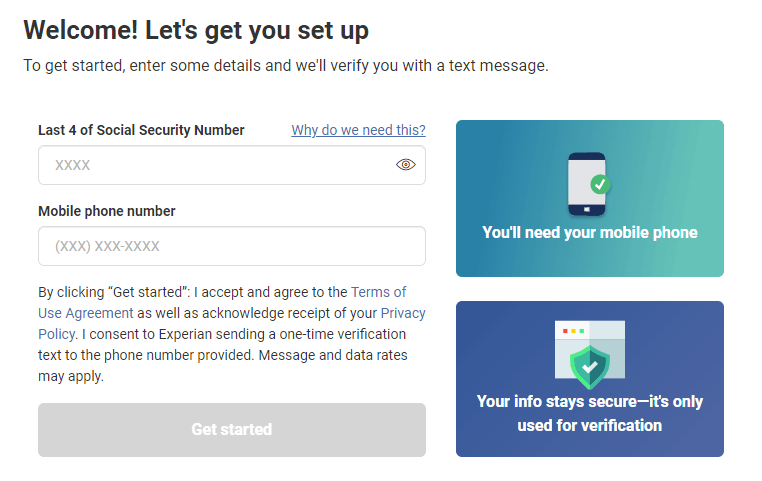

Below is a screenshot from when I registered with IdentityWorks to test out the service.

Note: As one might expect, joining IdentityWorks involves providing a considerable amount of personal data.

Users are required to provide personal information such as their Social Security number, birthday, and phone number for identity verification.

Once an account is created, users can immediately access key data points like their FICO score, percentage of credit usage, and total debt. The dashboard also provides actionable items and resources, including the ability to lock your credit file, view alerts, and perform a free child ID scan, all through the user-friendly Experian dashboard.

Mobile app

Quick Tip: For easy credit and identity management on the go, download the Experian app for iPhone and Android. Simply search for “Experian” in your app store to find it, as there’s no specific app for IdentityWorks.

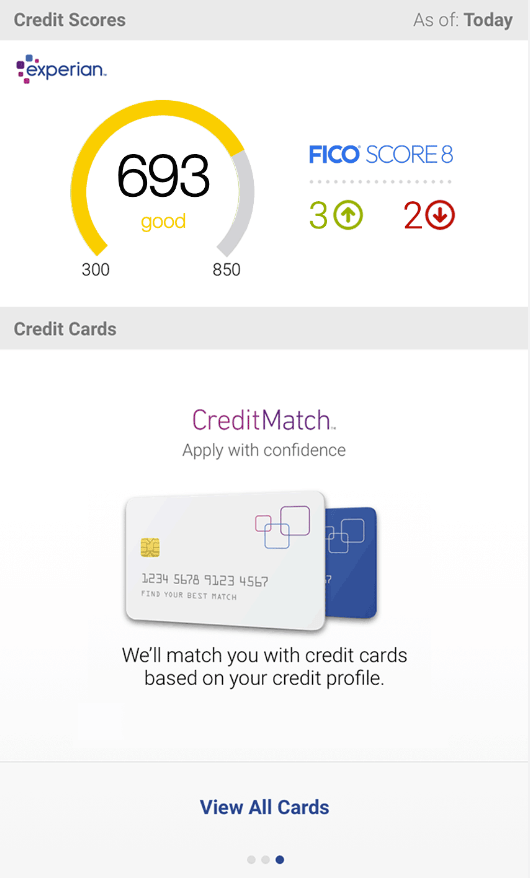

The Experian IdentityWorks mobile app is a well-designed tool that lets you monitor your identity while on the move. Here’s what the app allows you to do with ease:

Access your account for continuous monitoring of your personal information, ensuring peace of mind wherever they are.

View detailed credit reports, providing a clear picture of their financial standing.

Check their FICO scores, keeping track of any fluctuations that could indicate potential identity theft.

Receive immediate and reliable alerts about any suspicious activities, allowing for quick action to protect their identity.

After trying it out, we’ve found that the app’s functionality and user-friendly design make it not only useful but also enjoyable to use. We think most users will feel the same.

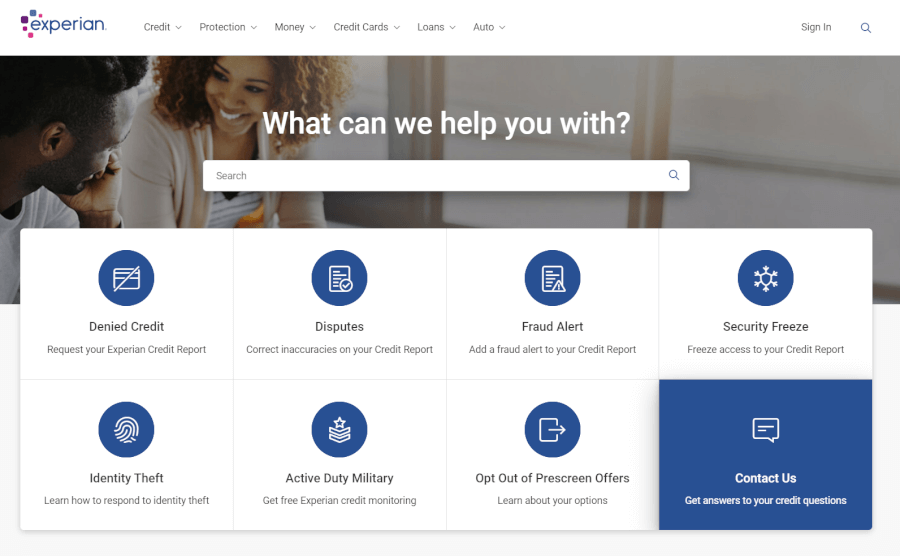

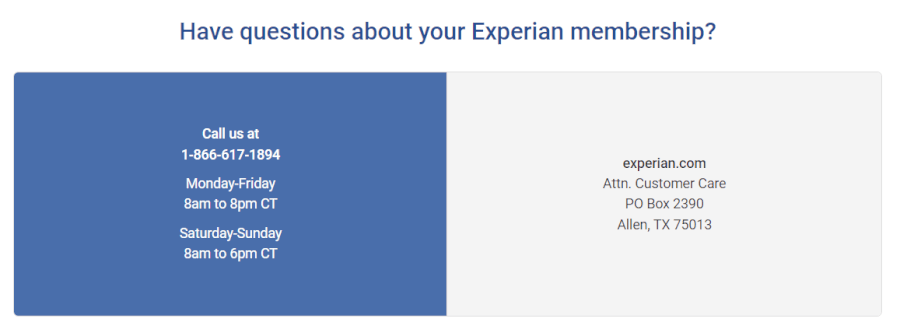

Customer support: What sort of help do you get with Experian IdentityWorks?

Experian does provide a toll-free customer support number, but its service falls short in several areas. The lack of 24/7 availability and real-time online chat options is a significant drawback, particularly in urgent identity theft situations where time is of the essence.

Customer feedback often highlights dissatisfaction with Experian’s customer support, particularly the feedback on Trustpilot. Our experience with their online help center was underwhelming. The absence of direct email support or a live chat feature led to a frustrating experience. Instead, we were redirected to a generic knowledge base, which, although somewhat informative, failed to offer the immediate, personalized assistance we wanted. The support center’s resources could also be more accessible to beginners, with clearer guides to navigate the service’s features.

Plans and pricing: Is Experian IdentityWorks worth your money?

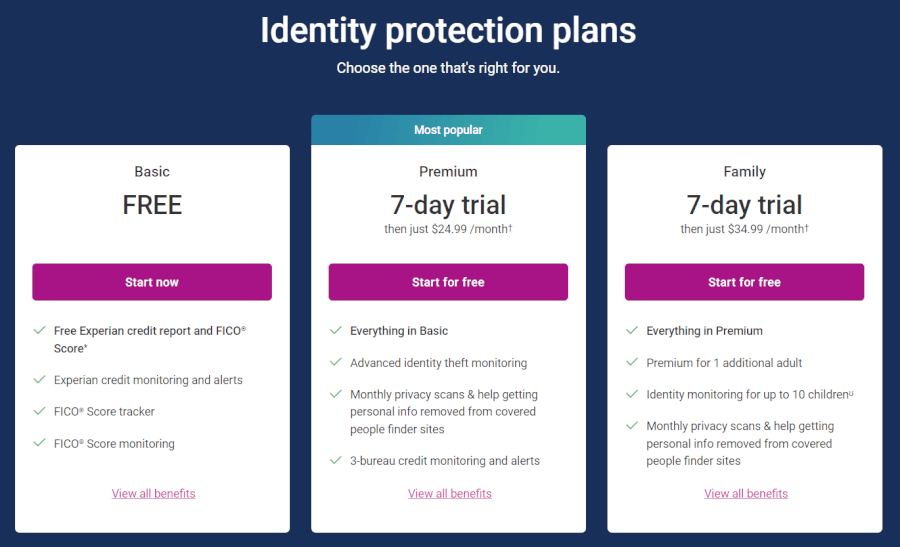

Experian IdentityWorks offers three plans: “Basic“, “Premium“, and “Family“, one of which is free of charge.

(opens in a new tab)”>You can see all prices and offers here >

The forever-free Basic plan offers main credit monitoring services, including access to your Experian credit report and FICO score. It provides alerts for any significant changes, helping to detect potential fraud. Subscribers also benefit from dark web surveillance and a privacy scan to uncover any exposed personal information online.

The Premium plan, at $24.99 per month, enhances the Basic offering with advanced identity theft monitoring, including monthly privacy scans to help remove personal info from people-finder sites. It provides comprehensive three-bureau credit monitoring, dark web surveillance alerts, financial account takeover, and Social Security number trace alerts.

At $34.99 per month, the Family plan includes all Premium features, plus coverage for one extra adult and up to 10 children, making it an ideal choice for family-wide identity protection.

All paid plans come with the added benefit of a 7-day trial to test the services. However, IdentityWorks tends to be pricier than many similar services.

How to get started with Experian IdentityWorks: A quick guide

Getting started with IdentityWorks is straightforward. Just follow these steps:

Create your account – Provide your SSN, birthday, and phone number on the Experian IdentityWorks website for identity verification.

Verify your identity – Complete the verification process to secure your IdentityWorks account.

Explore your dashboard – Log in and view your FICO score and perform a dark web scan via the dashboard.

Choose a plan – Select from the Basic, Premium, or Family plans based on your protection needs.

Confirm and activate – Confirm your plan choice, set up your account preferences, and start using the service.

With these steps complete, you’re now ready to take control of your personal identity protection with IdentityWorks.

How secure and private is Experian IdentityWorks?

Experian IdentityWorks uses secure sockets layer (SSL) technology to maintain encrypted communication between the user’s browser and its servers, aiming to protect personal data from unauthorized access. An automatic logout feature has been implemented to enhance security, which activates after 15-20 minutes of inactivity, thus helping to secure user accounts in case of inadvertent neglect to log out.

In terms of user authentication, IdentityWorks requires not just a password but also the last four digits of the user’s SSN upon each login. This approach to security, combining a password with the last four digits of a user’s Social Security number, aims to strengthen account protection.

As for privacy, IdentityWorks may not be the best fit for those who prioritize confidentiality above all else. The service’s multi-factor authentication (MFA) does make your account more secure. However, it’s also good to know what kind of personal information Experian collects.

As a company operating under US laws, Experian could be obligated to share customer data with government agencies under international surveillance agreements like the Five Eyes, Nine Eyes, and 14 Eyes. Their privacy policy is transparent about the types of user data they gather, which ranges from IP addresses and device details to visitation patterns and crash reports. While Experian does state that they may share aggregated and anonymized data with third parties for advertising, users can opt out of this.

For those who prioritize privacy, we suggest being cautious with IdentityWorks due to past data breaches and how they handle user data.

Note: If you’re interested in learning more about how Experian handles personal information, you can check Experian’s Privacy Policy and visit the Experian’s Privacy Center.

Experian IdentityWorks alternatives: How does it compare to competitors?

While IdentityWorks offers solid identity theft protection, it’s good to look around. Services like IdentityForce, Aura, and IDShield each bring something special to the table.

IdentityForce is great for watching over your credit and bank accounts, and it has a $1 million insurance policy. But, it doesn’t have the malware protection you get with Experian. Aura is a hit for families because of its good prices and features that focus on keeping everyone covered. If you just want to keep an eye on your Experian credit report, their free plan might be all you need. IDShield has been around for a while and is known for keeping a close watch on your personal info.

Each option has its perks, so it comes down to what’s important to you – whether that’s protecting the whole family, managing your credit, or finding a budget-friendly choice.

Conclusion: Is Experian IdentityWorks right for you?

Experian IdentityWorks offers extensive features like credit and social media monitoring, as well as identity theft insurance. However, you should note that your sensitive data might be used for third-party advertising, and the company’s past data breaches could be a concern for privacy-conscious individuals.

You can reach out to customer support for help, but keep in mind that they don’t offer live chat, which might slow down how quickly you get assistance.

In the end, IdentityWorks might be a good fit for those looking for robust identity protection. However, it’s essential to weigh your priorities, such as privacy, quick customer support, and ease of use, before making a decision.

Other identity theft protection reviews on RestorePrivacy:

Experian IdentityWorks FAQ

What does Experian IdentityWorks do?

Experian IdentityWorks draws upon the extensive credit monitoring knowledge of its parent company, Experian, to keep you informed of any changes to your credit reports. With its premium plans, you’ll receive alerts from all three major credit bureaus, giving you a well-rounded view of your credit health.

But there’s more to IdentityWorks than just credit monitoring. It also watches over public records, the dark web, and social media channels for any signs that your identity might be at risk.

Should you ever find yourself dealing with identity theft, IdentityWorks is there to help. Their team of fraud resolution specialists will guide you through sorting out the aftermath, including any legal issues. And with up to $1 million in insurance coverage for financial losses related to identity theft, you’ll have extra peace of mind.

Does Experian IdentityWorks come with a money-back guarantee?

While Experian IdentityWorks doesn’t offer a money-back guarantee, it does feature a 7-day free trial for its premium services. This trial period allows you to fully experience the service and determine if it aligns with your needs without any initial financial commitment. Should you decide it’s not the right fit, simply cancel within those seven days to avoid any charges.

How secure is Experian IdentityWorks?

Experian IdentityWorks takes several steps to safeguard user data, employing SSL technology for secure communications and an automatic logout feature to prevent unauthorized access. Users also have the option to enhance their account security with additional authentication measures, such as security questions or PINs.

Also, logging in requires not just a password but also the last four digits of the user’s Social Security number, adding an extra layer of protection for personal information. However, given Experian’s history of data breaches and its handling and potential sharing of user data, privacy-focused individuals should hesitate to use their services.

This Experian IdentityWorks review was last updated on April 24, 2024.

Experian offers a free account that makes possible this and info for the other credit bureaus

[https://usa.experian.com/mfe/member/login]

What is the difference between a security freeze, Experian CreditLock, and a fraud alert?

Security freeze –

To help protect yourself against credit fraud and identity theft, you can request a security freeze from any of the three major credit bureaus (Experian®, Equifax® and TransUnion®). You’ll need to contact each bureau individually to place a security freeze. You can temporarily unfreeze to allow specific creditors to review your information. To manage your Experian freeze, sign in to your Experian account and visit the freeze center.

Security freeze features

Blocks most creditors from accessing your credit file.

Doesn’t include monitoring or alerts of attempted credit inquiries.

May slow down your application for credit.

Your Experian credit report and FICO® Score can still change if in a frozen state.

You can use Experian CreditLock while your credit file is frozen.

Experian CreditLock

Experian CreditLock gives you control over who can view your credit file. CreditLock offers similar protection to a security freeze, but with additional advantages.

CreditLock features:

Includes daily monitoring and attempted inquiry alerts if someone applies for credit while your file is locked.

Allows you to block access to your credit file.

Lets you lock and unlock your file easily and quickly, without delaying the application process.

Included with your Experian paid membership.

Blocks access to your Experian credit file only.

To lock or place a security freeze on your Equifax® or TransUnion® credit files, you’ll need to contact the bureaus directly.

Your Experian credit report and FICO® Score can still change if you use CreditLock.

Fraud alert

If you suspect you are or may become a victim of identity theft, you can place a one-year fraud alert on your credit file. A fraud alert filed with one of the three major credit bureaus will be shared with the other two bureaus.

Fraud alert features:

Lets lenders or creditors know they should verify your identity before approving you for new credit.

Only available if you suspect you are or may become a victim of identity theft or credit fraud.

Doesn’t block inquiries or other credit activity.

Initial alerts only last one year but can be renewed for another year. You may apply for an extended fraud alert that will last for seven years, provided you have evidence your identity has been compromised.

Your Experian credit report and FICO® Score can still change if you add a fraud alert.

Contact Experian to place a fraud alert at: 1-855-246-9409

The article has conflicts, this is the order they show up reading start to finish.

Key takeaways

– and a family plan that broadens protection to include adults and unlimited children within a household. [An extra adult – 10 children ?]

Experian IdentityWorks pros and cons

– Credit monitoring across all three major bureaus – Keeps an eye on your credit reports from Experian, Equifax, and TransUnion to promptly identify any suspicious changes that could indicate fraud.

*That’s for paid plans is not noted to exclude the basic plan that monitors Experian CR only.

[a no-cost plan featuring basic monitoring of your Experian credit report to premium options that provide comprehensive monitoring across all three major credit bureaus, * * The forever-free Basic plan offers main credit monitoring services, including access to your Experian credit report and FICO score. It provides alerts for any significant changes, helping to detect potential fraud. Subscribers also benefit from dark web surveillance and a privacy scan to uncover any exposed personal information online.]

– The ability to add an extra adult and up to 10 children to the family plan [Total # adults allowed in FP not called out?]

Experian IdentityWorks feature summary

– Child identity protection – The family plan option allows for up to 10 children, providing vigilant monitoring to keep your kids’ identities safe. [Not unlimited children as review has, 18 & under living at home if thats true because age is not covered by review?]

Experian is a key player among the “Big Three” credit-reporting agencies, along with TransUnion and Equifax. Troublesome is you have to unveil any hearsay online personna to a legal recorded identity with a global data analytics titan, company headquartered in Dublin, Ireland.

Sensitive data might be used for third-party advertising, and the company’s past data breaches could be a concern for privacy-conscious individuals. So a US resident paying to be profiled in other words outside the USA borders for identity protection. Say eck!