Choosing the right identity theft protection service is crucial for keeping your personal information safe. These services monitor your personal and financial data, alerting you to any suspicious activity and providing recovery assistance if your identity is compromised. With robust security features, they protect against financial fraud and cyber threats, making them a must-have in today’s digital world.

Identity theft can lead to financial loss, damage to your credit score, and emotional distress. That’s why investing in a reliable identity theft protection service is so important for securing your personal information.

In this guide, we’ll compare the top services, looking at their features, costs, and customer support to help you make the best choice. We evaluated each contender based on their monitoring tools, cybersecurity features, ease of use, and our own experience in testing out these services. Our goal is to highlight the best options to protect you and your family from identity theft.

Key points for finding the best identity theft protection service

The best identity theft protection services should offer comprehensive security features, including financial fraud protection, cyber protection tools like antivirus software and VPNs, and up to $1 million in identity theft insurance.

- When choosing an identity theft protection service, consider monthly costs, the range of monitoring tools and cybersecurity features, money-back guarantees, and customer reviews to ensure maximum security and value.

- Top identity theft protection services provide extensive protection through features like three-bureau credit monitoring, dark web monitoring, and advanced AI-powered alerts. They cater to various needs with plans for individuals and families, offering premium cybersecurity tools.

- Based on our test results, the best identity theft protection service is Aura, and you can get it with a 68% off coupon here.

Ranking identity theft protection services: How do we choose the best ones?

Choosing the right identity theft protection service can feel overwhelming, but we’ve done the legwork to help make it easier. Our evaluation process ensures you get the best security and value for your money. Here’s a rundown of how we ranked these services based on our own experience:

Cost and value: We compared the monthly costs of plans from each service to see which ones give you the most bang for your buck. It’s important to find a plan that fits your budget without compromising on essential features.

- Discounts and guarantees: We love a good deal, so we looked into which services offer annual discounts or exclusive special pricing. Additionally, we wanted to find services that back up their promises with a generous money-back guarantee.

- Comprehensive protection: We scrutinized the details of each plan, checking if they included vital cybersecurity tools like antivirus software, virtual private networks (VPNs), password managers, and parental controls. These extras are crucial for full device protection and providing peace of mind.

Credit monitoring: Monitoring your credit from all three bureaus is a must for catching any suspicious activity. We made sure to highlight services that offer this feature as part of their package.

Dark web monitoring: We looked at which services provide dark web monitoring to alert you if your personal information is found where it shouldn’t be.

Identity theft insurance: We checked the identity theft insurance each service offers. It’s good to know you’re financially covered if something goes wrong.

By evaluating factors such as cost, features, and customer support, we can find the best service to meet your needs and protect you from potential identity theft threats.

Best identity theft protection services: Our top picks for 2024

After thorough research and rigorous testing, we present the top five identity theft protection services for 2024, emphasizing their security, performance, and unique features:

- Aura – Top-notch identity protection with quick threat alerts and up to $5M insurance for families. Aura is also unmatched in terms of value, especially with this 68% off coupon.

- LifeLock – A rock-solid choice, enhanced by Norton 360 antivirus software to ensure thorough protection.

- Identity Guard – Alongside core features, this service offers security extras including a password manager, safe browsing tool, and unlimited children with family plans.

- IdentityIQ – With Bitdefender on board, this jack of all trades ramps up its security suite with antivirus and VPN services.

- IDShield – An all-encompassing service that excels in the market with its licensed private investigators and insurance coverage of up to $3M.

In the next sections, we’ll dive deeper into our top picks for identity theft protection available today. We’ll share what makes each service stand out, their best features, and how well they guard against identity theft.

Aura – All-encompassing protection for all

Aura provides exceptional all-round protection with its comprehensive identity monitoring toolkit. We’ve found that Aura goes beyond just monitoring credit files from the major bureaus – it actively detects potential threats and alerts you promptly. What’s really impressive is its spam call protection, ensuring a secure user experience. Aura also offers up to $1M in identity theft insurance per member (up to $5 with family-focused packages) and round-the-clock customer support, which has been helpful in urgent situations.

The built-in VPN service ensures anonymity across multiple devices, while the password manager keeps accounts secure by flagging compromised or weak passwords. We’ve found the antivirus software effective against malware and other cyber threats, providing peace of mind.

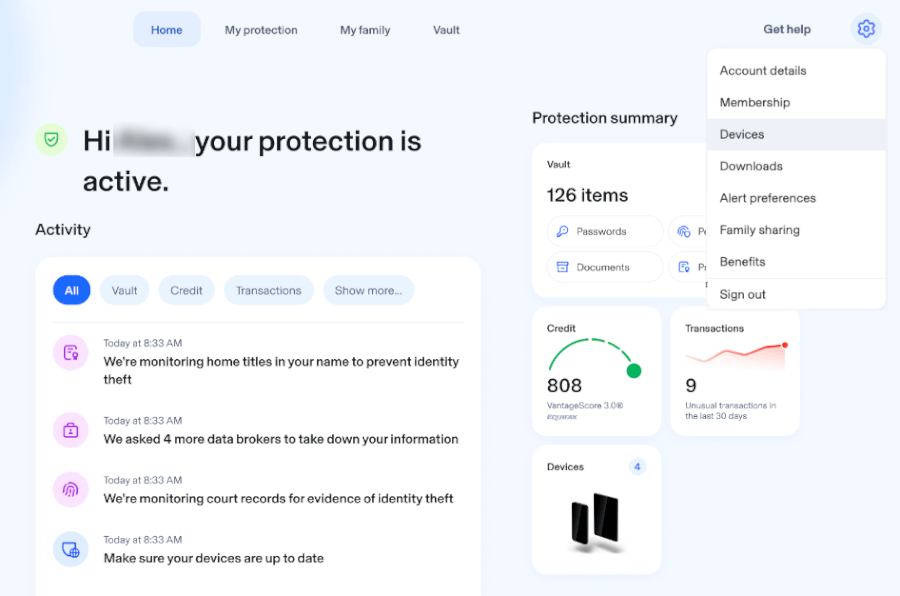

Aura’s dashboard is intuitive and user-friendly, allowing easy access to features like credit monitoring, dark web scans, and real-time alerts. Check the screenshot below for an example of its streamlined design:

Aura’s dark web monitoring is thorough, constantly scanning for leaks of personal information and notifying users of any breaches. Additionally, its financial transaction monitoring keeps a watchful eye on credit, banking, and investment accounts for any signs of fraudulent activity.

One unique feature, CreditLock, allows users to lock their Experian credit report to prevent unauthorized access, a handy tool for added security. In case of a lost wallet, Aura assists promptly with card cancellation and develops a recovery plan to safeguard your identity. Plus, their 60-day money-back guarantee on annual subscriptions adds confidence to your investment.

To sum up, Aura’s extensive array of tools – from vigilant dark web monitoring and real-time financial alerts to a secure VPN – alongside stellar customer support and up to $1 million in identity theft insurance, positions it as the ultimate solution for complete identity protection.

See the latest Aura prices and deals: https://aura.com/save-50-offers

Aura pros and cons

Let’s take a look at the strengths and weaknesses of opting for Aura to protect your digital identity:

+ Pros

- Antivirus software across all plans

- Comprehensive identity theft protection and credit monitoring services

- Dark web monitoring

- Fraud call protection

- Up to $1 million in insurance coverage

- Plans for individuals, couples, and families

- Useful parental control app

- Password manager and VPN included

- 24/7 customer support and fraud resolution

- Transparent pricing

- 3-bureau credit monitoring included in all plans

– Cons

More expensive than some competitors

Exclusive Aura Coupon:

Get 68% Off Aura subscription plans with the coupon below:

(Coupon is applied automatically; 60 day money-back guarantee.)

Check out our detailed Aura review for more insights.

Identity Guard – AI-powered alerts for full-scale security

Identity Guard harnesses the cutting-edge power of IBM Watson AI to provide top-tier identity theft protection and monitoring. This high-tech approach ensures quick alerts about data breaches, dark web activity, and risky transactions. With AI driving these alerts, they’re more accurate and timely, making it easier to stop identity theft in its tracks.

Identity Guard offers various plans tailored to different needs. The “Ultra” plan is the most feature-rich, offering credit monitoring from Experian, Equifax, and TransUnion, monthly credit score updates, Experian credit lock, and annual three-bureau credit reports. Alerts are sent via email, text, or phone, so you can swiftly act to protect your information.

On the other hand, the “Value” plan doesn’t include credit monitoring, which is a drawback compared to basic plans from competitors like LifeLock. The “Total” plan offers daily monitoring and credit score updates but lacks credit reports. On the bright side, all plans include up to $1 million in insurance to cover financial losses from identity fraud, offering you peace of mind.

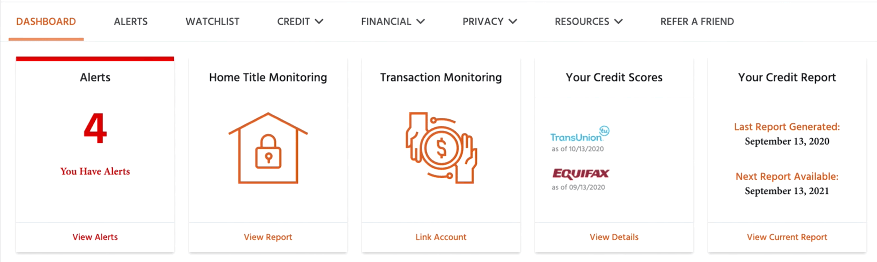

Identity Guard’s interface is user-friendly on both desktop and mobile apps, making it easy to manage and monitor your identity protection. We found the desktop version especially helpful for getting a comprehensive view of our security status – below, you can see a snapshot of the Identity Guard dashboard:

While Identity Guard lacks extras like a VPN service and extra cybersecurity tools, and the premium plans can be pricey, Identity Guard remains a strong choice for identity theft protection thanks to its advanced features and transparent pricing.

Identity Guard pros and cons

Let’s assess the advantages and limitations of relying on Identity Guard for your digital identity protection.

+ Pros

$1 million in identity theft insurance on all plans

AI-powered identity monitoring

Extra alerts are helpful

Simple-to-understand, upfront pricing

US-based customer support

Comprehensive individual or family coverage

Password managers included in all plans

Family plan protects an unlimited number of children

Budget-friendly basic plan

Predictive risk management score

– Cons

Pricey high-tier plan

Monthly credit score or credit card monitoring requires a more expensive plan

Limited cybersecurity tools

Check out our comprehensive Identity Guard review for more insights. To see how Identity Guard measures up against our top choice, check out our Aura vs Identity Guard comparison.

LifeLock – Combining forces with Norton 360 for ultimate security

In collaboration with Norton 360, LifeLock delivers a suite of identity theft protection services to keep your personal information safe. It keeps a vigilant eye on your credit reports and scours the dark web for any signs of your sensitive data. If something seems amiss, LifeLock is quick to send you an alert. While no service can guarantee absolute protection or track every transaction, LifeLock offers a safety net with its recovery assistance.

LifeLock’s interface is intuitive and user-friendly, simplifying navigation through credit monitoring, dark web scans, and alerts. See the screenshot below for a glimpse of its streamlined design:

LifeLock works with Norton 360 to add antivirus protection to its services, and it includes Norton Secure VPN with family-focused plans. However, lower-tier plans offer basic credit monitoring, often covering just one bureau without free credit reports. For comprehensive coverage, consider Aura, which provides 3-bureau credit monitoring across all plans.

To fully protect your credit with LifeLock , you’ll need to freeze or lock your credit files with Experian and Equifax separately since LifeLock only does this for TransUnion. Still, LifeLock makes protecting your TransUnion credit file simple, adding a security layer that’s both effective and easy to use.

Although LifeLock doesn’t come with Norton antivirus software or VPN on its own, you can pair it with Norton 360 for a stronger online defense, but this will incur additional costs.

LifeLock monitors personal information such as your Social Security number (SSN), credit card details, and other sensitive data to detect unauthorized use. This extends to dark web surveillance, where it scans databases for any trace of your data, alerting you to potential exposure. Additionally, LifeLock keeps an eye on your financial transactions, providing alerts for any suspicious activities, allowing you to act quickly to minimize damage.

In case of a lost wallet, LifeLock helps you quickly cancel and replace important cards and documents. It also offers financial protection with up to $1 million in insurance to cover losses due to identity theft across all plans. In their premier tier, you get the same amount for reimbursement of stolen funds.

LifeLock also offers 24/7 customer support to assist with any issues or concerns and recently introduced a 30-day free trial period, allowing new users to experience the service before committing.

See the latest prices and deals: https://lifelock.norton.com/offers

LifeLock pros and cons

Let’s explore the pros and cons of choosing LifeLock for your digital identity protection.

+ Pros

30-day free trial period (recently added)

A VPN with family plans

Comprehensive identity theft protection service

Can be combined with Norton 360 antivirus software

Up to $1 million insurance for certain costs incurred from identity theft

User-friendly interface and easy setup

Stolen wallet protection

Simple-to-use mobile apps

– Cons

3-bureau monitoring is available in higher-tier plans only

Confusing paid plan structure

Higher cost compared to some competitors

For a more detailed analysis, check out our comprehensive LifeLock review. To see how LifeLock stacks up against our top pick, check out our Aura vs LifeLock comparison.

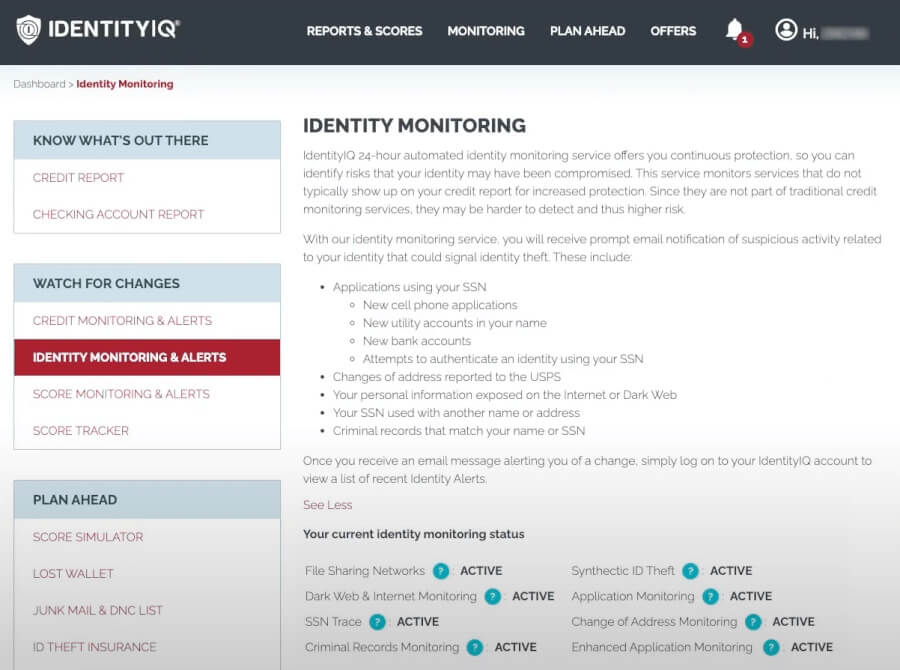

IdentityIQ – Tiered protection with comprehensive coverage

IdentityIQ offers a tiered approach to identity theft protection, catering to various levels of coverage and insurance needs. Each tier provides different degrees of protection, with the “Secure Max” plan delivering the highest level. This top-tier plan includes $1 million in identity theft insurance, synthetic identity theft monitoring for children, application monitoring, and credit building with utility payment reporting. Additionally, it offers monthly access to full credit reports and robust fraud restoration features.

One of the standout features of IdentityIQ is its partnership with Bitdefender, enhancing its security suite with antivirus and VPN services. This collaboration ensures multi-layered data protection, though you should be aware of potential privacy concerns due to data sharing with third parties and government entities.

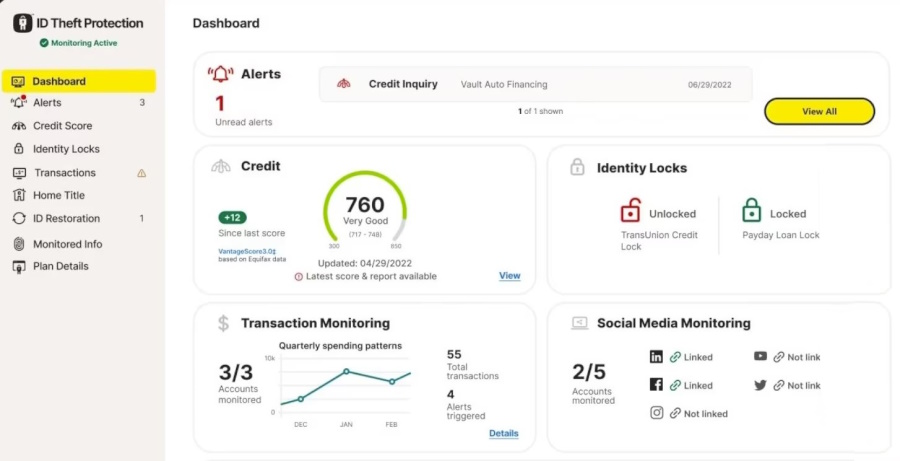

The service’s mobile app keeps users updated with real-time alerts on any suspicious transactions, making it a comprehensive yet affordable option for identity theft protection. Likewise, IdentityIQ’s dashboard is intuitive and user-friendly – see the screenshot below:

IdentityIQ also provides lost wallet assistance, helping you replace important documents and cards if your wallet is lost. The US-based ID restoration service offers dedicated support for identity restoration, ensuring you have the necessary help when needed.

To wrap things up, IdentityIQ offers solid identity theft protection with features like credit monitoring across all three bureaus, dark web monitoring, and identity restoration services. It provides a comprehensive defense against identity fraud with various plans tailored to different needs. The advantages include extensive monitoring services, $1 million in identity theft insurance, and user-friendly interfaces.

While there are some drawbacks, such as privacy concerns related to data sharing with third parties, IdentityIQ remains a strong option for those seeking reliable identity protection.

IdentityIQ pros and cons

Let’s weigh the pros and cons of choosing IdentityIQ for your digital identity protection:

+ Pros

$1 million stolen funds reimbursement with all plans

AI-driven approvals and recommendations

Affordable integration with antivirus and VPN

Easy setup with out-of-the-box connectors

Monthly credit scores and reports

User-friendly system and organized interface

Family protection included

Three-bureau credit monitoring available

– Cons

Data sharing with third parties

Higher costs with extra charges for add-ons

No free trial or version is available

Limited customer support options

For an in-depth analysis of IdentityIQ’s offerings, read our detailed IdentityIQ review. Learn more about how IdentityIQ compares to our preferred option in our Aura vs IdentityIQ comparison.

IDShield – Pocket-friendly identity protection for families

IDShield offers budget-friendly family plans with robust monitoring services and thorough identity theft assistance. Starting at just $29.95, these plans can cover up to 11 family members, making it an affordable option for large households.

It covers credit report monitoring from TransUnion, with optional monitoring from Experian and Equifax, alerting you to new inquiries or accounts. Dark web monitoring scans for personal details like credit card numbers or medical IDs, and SSN monitoring keeps a constant watch to quickly identify any unauthorized activity.

IDShield also provides up to $3 million in coverage for legal fees and expenses due to identity theft. Licensed private investigators are on hand to help restore your identity if it’s ever stolen. Additional features include VPN protection via Proxy One to secure your internet connection, malware protection to defend against malicious software, and a password manager to securely manage your passwords. Parental controls help you manage your children’s online activity, keeping them safe from digital threats.

The service also offers social media scanning to spot potential privacy breaches or harmful content, and public and court record monitoring to detect identity theft indicators like address changes or court judgments. Medical data reports review claims and records to ensure your information isn’t used fraudulently. Reputation management services help you maintain a positive online presence, and lost wallet support assists with canceling and replacing credit cards and identification documents.

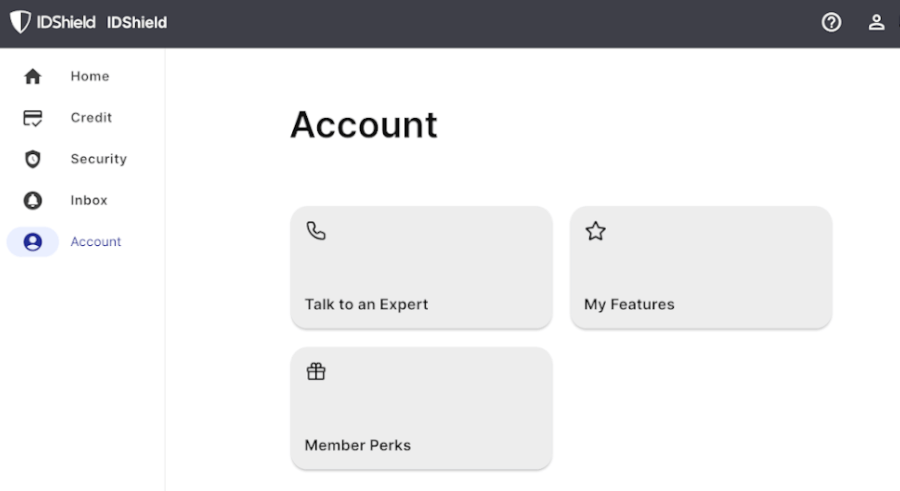

Lastly, IDShield’s interface is designed for user-friendliness, making it easy to manage your protection, as shown below:

The initial setup might require creating several login profiles on third-party sites, but once that’s done, the interface is user-friendly and easy to navigate. Overall, IDShield provides a comprehensive and affordable solution for families wanting to protect their identities without breaking the bank.

IDShield pros and cons

Let’s take a closer look at both the positives and negatives of opting for IDShield for your digital identity protection:

+ Pros

Credit file and personal info web scanning

Instant misuse alerts on all plans

Identity theft recovery aid including lost wages

Credit monitoring with one or three bureaus

SSN tracking for unauthorized use

Dark web checks for personal data leaks

Financial account vigilance

Complimentary Trend Micro security suite (VPN, antivirus, and password manager)

Licensed private investigators for theft restoration

– Cons

Confusing and cumbersome setup

Basic plans cover only TransUnion

No discounts for yearly plans

Bare-bones password manager

For a comprehensive look at IDShield’s features and benefits, check out our detailed IDShield review. To compare IDShield with our top pick, explore our Aura vs IDShield comparison.

Understanding identity theft protection services

Identity theft protection services are crucial in today’s digital landscape, where personal information is constantly at risk. Understanding how these services work and what features to look for can help you choose the right protection for your needs. Let’s break it down so you can make an informed decision and keep your personal data safe.

What are identity theft protection services?

Identity theft protection services, provided by identity theft protection companies, are designed to safeguard against identity theft and offer a range of identity theft services such as:

Detecting potential misuse of personal data: This includes monitoring for unauthorized loan applications, new accounts on credit reports, and other suspicious activities.

Monitoring personal accounts: These services keep an eye on various accounts, including bank accounts, credit cards, and social media accounts, to detect any unusual activity that could indicate identity theft.

Alerting users to suspicious activities: Users receive real-time alerts about any suspicious activity, enabling them to take immediate action to protect their identity.

Identity restoration assistance: In the event of identity theft, these services often provide dedicated support to help restore your identity, including assistance with paperwork and contacting relevant institutions.

Fraud resolution: They may offer services to help resolve fraudulent transactions and clear your name from any false accusations.

- Identity theft insurance: Many services include insurance that can cover financial losses and legal fees incurred as a result of identity theft. This can provide significant financial relief and support during recovery.

Common types of identity theft include various fraudulent activities that can severely impact your financial stability and personal security – these include:

Credit card fraud: Unauthorized use of your credit card information to make purchases or withdraw funds.

Loan fraud: Using your personal information to apply for loans or credit lines in your name.

Medical identity theft: Stealing your personal information to obtain medical services or drugs, which can result in inaccurate medical records and financial loss.

Financial identity theft: Unauthorized access to your bank accounts or other financial assets.

These services often include additional features such as various monitoring tools, alerts, and support options to enhance overall security and protection – these often include:

Dark web monitoring: Scanning the dark web for your personal information, alerting you if your data is found in places where it shouldn’t be.

SSN trace alerts: Monitoring for any use of your SSN in activities such as new credit applications or changes in address.

Privacy scans: Removing your personal information from public websites and reducing your digital footprint to prevent unauthorized access.

While these services provide comprehensive protection and support, it’s important to note that most do not cover direct financial losses from fraudulent purchases. However, the proactive measures they offer can significantly reduce the risk of identity theft and help you recover more efficiently if it occurs.

How do identity theft protection services work?

Identity theft protection services alert users immediately upon detecting compromised data, helping to prevent fraud. These services work around the clock to monitor changes to your credit files, such as unauthorized loan applications. They also offer useful features like dark web scans to check if your personal information is being sold online, privacy scans to remove your data from public websites, and SSN trace alerts to notify you of any suspicious activity.

These services scan various databases and public records using sophisticated algorithms and AI to detect fraudulent activity. Real-time alerts via email, text, or app notifications prompt users to take immediate action upon detection of potential threats.

Comprehensive credit monitoring across Experian, Equifax, and TransUnion ensures timely detection of new credit inquiries or accounts opened in the user’s name. Some services also provide credit score tracking and monthly credit reports to help users keep an eye on their financial health.

Advanced services may include cybersecurity tools like antivirus software, VPNs, and password managers for comprehensive personal security. Lost wallet protection assists in quickly canceling and replacing important documents and cards. In cases of identity theft, dedicated support from fraud specialists helps with recovery, including filing police reports and contacting financial institutions.

How to choose the right identity theft protection service for you?

Choosing the right identity theft protection service doesn’t have to be a daunting task. By evaluating your personal risk level, comparing service features, and considering the service’s customer support and reputation, you can find the best protection for your needs.

Evaluate your risk for identity theft

Choosing the right identity theft protection service starts with understanding your risk level. This means considering the type of personal data you want to protect and identifying the potential risks you face.

Think about how you use the internet. If you frequently use online banking, make online purchases, or share personal information on social media, your risk of identity theft is higher. In such cases, you might need a service like LifeLock and IDShield – equipped with comprehensive protection features like dark web monitoring, real-time alerts, and advanced encryption.

On the other hand, if you’re someone who rarely uses the internet and mostly handles transactions in person, a basic plan might suffice.

Check the kind of information that is monitored

When selecting an identity theft protection service, it’s crucial to understand what types of personal data they monitor. Look for services that cover a wide range of information such as Aura and McAfee. This should include your SSN, bank accounts, credit cards, and even your social media accounts. Additionally, consider services that monitor public records such as sex offender registries, tax records, and property records.

Comprehensive monitoring ensures that any unauthorized use of your personal information is quickly detected and addressed.

Make sure the service covers all three credit bureaus

For thorough protection, choose a service that monitors your credit reports from all three major bureaus: Experian, Equifax, and TransUnion. This comprehensive coverage helps ensure that any suspicious activity is caught, no matter where it appears.

For instance, Aura ensures comprehensive monitoring across all three major credit bureaus in every plan. This guarantees thorough protection, leaving no gaps in your coverage.

Find out all about their identity theft insurance

Imagine the peace of mind knowing that if your identity is compromised, you’re not alone in dealing with the aftermath. This insurance can cover the costs associated with recovering your identity, such as legal fees, lost wages, and other expenses. So, be sure to check the coverage limits and what exactly is included in the insurance policy. Some services offer up to $1 million in coverage, providing a significant financial cushion if your identity is compromised.

Get the full details on their recovery services

In the unfortunate event that your identity is stolen, you’ll want a service that doesn’t just leave you hanging. Look for one that offers strong recovery assistance.

This means having access to dedicated case managers or fraud specialists who can guide you step-by-step through the process of restoring your identity. They should help you with filing police reports, contacting banks, and disputing fraudulent charges. You want a service that supports you, making a stressful situation much more manageable.

Evaluate ease of use (a user-friendly mobile app is a plus)

The best identity theft protection services are user-friendly and come with intuitive mobile apps. These apps allow you to monitor your accounts, receive real-time alerts, and manage your protection on the go. A well-designed app can make a significant difference in your ability to respond to potential threats.

Services like Aura vs Incogni offer highly-rated mobile apps that make it easy to stay protected. Aura’s app provides access to features like credit monitoring and dark web scans, while LifeLock’s app, in partnership with Norton 360, integrates antivirus protection and a secure VPN. These user-friendly apps ensure that even those who aren’t tech-savvy can easily navigate and stay secure.

Look for solid security extras such as VPN, antivirus software, and password manager

Many top-tier identity theft protection services offer additional cybersecurity tools to enhance your overall protection. These can include a virtual private network (VPN) for secure internet browsing, antivirus software to protect against malware, a password manager, and an ad blocker to keep your login credentials safe. These extras provide a comprehensive shield against various cyber threats.

For instance, Aura goes above and beyond by including a built-in VPN service, ensuring your online activities remain private across multiple devices. They also offer a password manager that flags compromised or weak passwords, keeping your accounts secure. Plus, their antivirus software is effective against malware and other cyber threats, giving you peace of mind.

Considering customer support and reputation

Customer support and the reputation of the service are also important factors to consider. Look for services that offer 24/7 customer support and have positive reviews from users. Imagine needing help at 2 AM and having someone ready to assist you – that’s the kind of support you want.

Good customer support can be invaluable, especially if you need immediate assistance with a potential identity theft issue. Additionally, check out user reviews to see how well the service has worked for others. A strong reputation often means the company delivers on its promises and provides effective protection.

Look for discounts, free trials, and money-back guarantees

Finally, consider the cost of the service and look for any available discounts, free trials, or money-back guarantees. Many services offer these options, allowing you to try out the service before committing to a long-term plan.

For example, Aura offers a 60-day money-back guarantee on annual subscriptions, ensuring peace of mind as you explore their features. Additionally, Aura provides a 68% discount coupon, making it easier and more affordable to secure comprehensive identity theft protection.

How to choose the right plan for you?

Choosing the best identity theft protection plan depends on your unique needs – whether you’re looking to protect just yourself or your entire family, and whether you prefer a budget-friendly option or a premium plan with all the bells and whistles.

Individual vs family-focused plans

For individuals, a basic plan might suffice, offering essential monitoring and alerts without breaking the bank. However, if you have a family, consider a comprehensive family plan that covers multiple members and provides additional features like parental controls, sex offender registry monitoring, and cyberbullying alerts.

An excellent example is Aura, which offers comprehensive plans for both individuals and families. Aura’s individual plans provide essential features like three-bureau credit monitoring, dark web monitoring, and up to $1 million in identity theft insurance. Meanwhile, for families, Aura offers up to $5 million in identity theft insurance for family plans, with up to $1 million per member, ensuring financial protection for every individual in your household.

Budget-friendly vs premium plans

Budget-friendly identity theft protection plans, like Aura, cost between$9 – $25/month (with the coupon) and offer robust cybersecurity features. These plans provide essential protection without breaking the bank while ensuring comprehensive coverage. Aura’s plans include three-bureau credit monitoring, dark web monitoring, and up to $1 million in identity theft insurance, making it a solid choice for those seeking effective yet affordable protection.

Starting from $89.99 to $424.99 per year, McAfee also includes advanced cybersecurity tools like antivirus software, a secure VPN, and identity monitoring services. While pricier, the additional features and robust security make it a worthwhile investment for those seeking top-tier protection. McAfee’s comprehensive suite ensures users are well-protected against a wide range of cyber threats, providing peace of mind and enhanced security.

Steps to take if your identity is stolen

Knowing the right steps to take if your identity is stolen can make a world of difference in speeding up recovery and minimizing damage. Immediate actions and long-term recovery strategies are key to navigating this stressful situation effectively.

Take immediate steps

Upon discovering identity theft, take the following steps:

Contact the companies where the fraud occurred: Reach out to the businesses involved and let them know about the identity theft. This helps stop the fraudulent activity in its tracks.

Report the identity theft to the Federal Trade Commission (FTC): Visit the FTC’s website and file a report. This creates an official record and helps authorities track identity theft trends.

File a police report: Head to your local police station and file a report. Provide a copy of this report, along with an Identity Theft Report, to the companies affected. This adds an extra layer of credibility to your claims.

Additionally, consider placing a fraud alert on your credit reports. This measure can help prevent further damage by making it harder for identity thieves to open new accounts in your name.

Plan for long-term recovery

Long-term recovery from identity theft requires vigilance and persistence. Regularly check your credit reports, especially in the first year after the incident, to ensure everything is in order. With the help of case managers and fraud specialists, identity theft protection services can guide you through the process.

Once you’ve addressed the identity theft issues, ask for letters from the companies involved that confirm the closure of any fraudulent accounts and the clearing of debts. This documentation ensures your credit report accurately reflects the resolved issues.

Set reminders to check your credit reports regularly and track any new activities. Staying organized with a dedicated folder for related documents and correspondence can save you time and reduce stress.

Remember, recovering from identity theft is a marathon, not a sprint. By staying vigilant and utilizing available resources, you can regain control of your financial health and prevent future incidents.

Extra tips to prevent identity theft

A proactive approach is required to prevent identity theft, which includes securing personal information, utilizing strong passwords, and maintaining online vigilance.

Here are some additional strategies to help you protect your identity.

Safeguard your sensitive information

It’s crucial to secure personal information in order to prevent identity theft. Here are some tips to help you protect your personal information:

Always verify the legitimacy of websites before sharing personal information – Think of it as double-checking a party invitation – you want to make sure it’s legit before you show up!

Avoid oversharing on social media – Your vacation photos are great, but broadcasting your location can be risky.

Check the privacy policies of websites to ensure your data is encrypted and protected – It’s like reading the fine print before signing a contract – boring but necessary.

Additionally, consider using identity theft protection services that offer privacy scans to remove your information from public websites and reduce your digital footprint. This proactive measure can significantly decrease your risk of identity theft and keep your personal information safe and sound.

Upgrade your security with strong passwords and 2FA

To protect your online identity effectively, use strong, unique passwords for each account. Here are some tips for crafting secure passwords:

Create passwords with at least eight characters.

Include a mix of letters, numbers, and symbols.

Avoid using easily accessible information like birthdays or common words.

Think of your password as your digital fortress – the more complex, the better!

Enabling two-factor authentication (2FA) adds an extra layer of security by requiring a second form of verification, such as a code sent to your phone. This makes it significantly harder for identity thieves to access your accounts, even if they manage to get hold of your password. It’s like having a double lock on your door – extra peace of mind.

Stay sharp and safe online

Maintaining online vigilance is all about being smart with the information you share and the websites you visit. Think of it like navigating a busy city – you wouldn’t give out your home address to strangers, right? Avoid responding to unsolicited requests for account numbers or passwords, as these are often phishing attempts designed to trick you.

To keep your online identity safe, follow these steps:

Download software only from trusted sites: It’s like eating at a reputable restaurant – you know it’s safe.

Ensure secure web pages for personal info: Look for ‘https’ and a padlock symbol – these indicators confirm that the site is secure and your data is encrypted.

Regularly update your software: Think of it as getting regular check-ups to keep everything running smoothly.

Use cybersecurity tools like antivirus and VPNs: These are your personal bodyguards in the digital world.

By following these steps, you can significantly enhance your online security and keep your identity safe from prying eyes.

Wrapping up: Secure your future with the right identity theft protection service

Identity theft protection services act as essential safeguards in the digital realm, ensuring your personal information remains secure from malicious actors. The best services for 2024 are packed with features like comprehensive credit monitoring, dark web scans, identity theft insurance, and extra cybersecurity tools, giving you that much-needed peace of mind.

Whether you’re looking for an individual plan, family coverage, budget-friendly options, or premium packages, the right identity theft protection service can offer a solid defense against identity thieves.

Among the top picks for 2024, Aura shines brightly with its extensive array of tools and exceptional customer support. With features like three-bureau credit monitoring, dark web monitoring, and advanced AI-powered alerts, Aura offers thorough protection for various needs.

Exclusive Aura Coupon:

Get 68% Off Aura subscription plans with the coupon below:

(Coupon is applied automatically; 60 day money-back guarantee.)

Their customer-focused approach, combined with up to $1 million in identity theft insurance, makes Aura a standout choice for safeguarding your identity.

Identity theft protection reviews on RestorePrivacy

Check out the identity theft protection reviews we’ve featured on RestorePrivacy:

Identity theft protection comparison guides on RestorePrivacy

We’ve checked out a lot of identity theft protection services and put together some comparison guides to help you find the perfect one. Dive into our full reviews by clicking the links below:

- Aura vs LifeLock

- Aura vs Experian IdentityWorks

- IDShield vs Aura

- Aura vs McAfee

- LifeLock vs IDShield

- Aura vs Incogni

- Aura vs IdentityIQ

- Aura vs IDShield

- Identity Guard vs Aura

- Identity Guard vs LifeLock

- LifeLock vs Experian Identity Works

Best identity theft protection services FAQ

What are identity theft protection services?

Identity theft protection services are important for monitoring your personal information and alerting you to any suspicious activities. They also provide identity theft insurance and assist in the recovery process if your identity is compromised.

How do identity theft protection services work?

These services work like a vigilant watchdog, constantly monitoring your personal and financial data for any unusual activities. They notify you of potential fraud, helping you stay one step ahead of identity thieves.

What should I look for in identity theft protection services?

When choosing an identity theft protection service, look for features like dark web monitoring, three-bureau credit monitoring, identity theft insurance, and real-time alerts. These elements are essential for robust protection against identity theft.

How do I choose the right identity theft protection plan?

Selecting the right plan involves assessing your risk level, comparing features and costs, and considering customer support and reputation. Find a plan that fits your needs and budget to ensure you get the best protection.

What should I do if my identity is stolen?

If your identity is stolen, act quickly: report the theft to the FTC, contact affected companies, file a police report, and consider using identity theft protection services to help with recovery. Prompt action can significantly reduce the impact of identity theft on your finances and personal information.

This guide on best identity theft protection services was last updated on August 1, 2024.

Leave a Reply