When it comes to protecting your personal info, it’s a wild digital world out there, which is why identity theft protection services are essential. These services keep a watchful eye on your credit reports, social security numbers (SSNs), and other personal details that should be just that – personal.

We’re here to unpack the details of Aura and LifeLock, two standout services in the identity theft protection arena. Our review will touch on user experience, trustworthiness, and the overall efficacy of each service to help guide you to a decision that’s right for you.

Both Aura and LifeLock boast robust identity theft protection offerings, yet they part ways when it comes to features and pricing. Aura brings to the table antivirus software, virtual private network (VPN), and credit monitoring from all three bureaus as part of its standard package. Meanwhile, LifeLock reserves extra features for premium users and tends to hike up renewal rates. It’s important to keep these differences in mind as you decide which service offers the best shield for your personal data.

| Aura | LifeLock | |

|---|---|---|

| Website | Aura.com | LifeLock.Norton.com |

| Pricing | $9 – $25/month | $7.50 – $32.99/month |

| Money-back guarantee | 60 days | 60 days |

| 3-bureau credit monitoring | Yes (all plans) | 1 bureau (3 bureaus with premium plans) |

| 24/7 customer support | Yes | Yes |

| Identity theft insurance | Up to $1 million (up to $5 million with family plans) | Up to $3 million |

| Best Deal | 68% Off Coupon > | 52% Off Coupon > |

Key takeaways from Aura and LifeLock comparison

Aura includes antivirus, VPN, and credit monitoring from all three bureaus in every plan, while LifeLock charges additional fees for these features and increases renewal pricing.

- Aura stands out with its consistent $1 million insurance across all plans, along with added security tools and a 60-day money-back guarantee for new users. LifeLock offers up to $3 million in remediation assistance, but only with their top-tier plan.

- In the trust department, Both Aura and LifeLock prioritize the security of their customer’s personal information. However, LifeLock has faced more substantial BBB complaints and regulatory hiccups compared to Aura, which may affect your trust in their services.

- In terms of value, Aura comes out on top, especially when you use this 68% off coupon.

How to select the right identity theft protection service: Aura vs LifeLock

Before we jump into the nitty-gritty of Aura versus LifeLock, let’s take a moment to walk through a quick guide on how to pick the right identity theft protection service:

- Monitoring: Identity theft protection services like Aura and LifeLock keep a vigilant eye on various data points to detect identity theft. They monitor public records, credit files, and even the dark web to spot where your personal information might be compromised. This comprehensive surveillance acts as an early warning system to identify threats.

- Protection: Beyond monitoring, these services provide tools to safeguard your information. They offer features like antivirus software, secure browsing, and spam call blocking. Additionally, they may help remove your personal information from data brokers and other harmful online locations, reducing the risk of identity theft.

- Notifications: Timely alerts are crucial in mitigating the damage caused by identity fraud. Aura and LifeLock send fraud alerts to notify you of suspicious activity, allowing quick action.

- Resolution: In the unfortunate event that identity theft does occur, both Aura and LifeLock offer dedicated support to guide you through the resolution process. They provide insurance to cover eligible expenses and losses, ensuring that you have the financial backing to recover from the incident.

Now, let’s quickly compare Aura and LifeLock to determine which service aligns with your identity theft protection needs.

Aura vs LifeLock: Side-by-side comparison

Let’s put Aura and LifeLock head-to-head in direct comparison to see which service might best suit your identity protection needs. Here is an overview of the key features:

| Aura | LifeLock | |

|---|---|---|

| Pricing | $9 – $25/month (with coupon) | $7.50 – $32.99/month |

| Family-focused plans and features | Yes | Yes |

| 3-bureau credit monitoring and reports | Yes (Experian, TransUnion, and Equifax) | 1-bureau (Equifax) or 3-bureau (Experian, TransUnion, and Equifax) |

| Dark web monitoring and alerts | Yes | Yes |

| Identity theft insurance | Up to $1 million | Up to $3 million |

| Social media account alerts | No | Yes |

| Credit lock | Yes | Yes |

| Lost wallet remediation | Yes | Yes |

| Antivirus and VPN | Yes | Yes but as an add-on for an extra fee |

| Password manager | Yes | No |

| 24/7 customer support | Yes | Yes |

| Best Deal | 68% Off Coupon > | 52% Off Coupon > |

Aura vs LifeLock: Which company is more trustworthy?

When assessing the trustworthiness of identity theft protection services, it’s important to look at factors like the company’s track record, the number of users, and how well they follow industry standards.

Now, let’s take a closer look at both of our contenders.

Aura overview

Founded in 2014 by Hari Ravichandran after his own credit information was compromised, Aura aims to make the internet safer. Today, it serves over a million members worldwide, united in their quest for online confidence.

This commitment to creating a seamless user experience has not gone unnoticed – Aura has been celebrated with accolades from Mom’s Choice Awards to Inc. Magazine and Forbes. Moreover, their TrustScore of 4.7 on TrustPilot, based on 523 reviews, is a testament to their unwavering dedication to service excellence.

Through the strategic acquisition of Identity Guard, Aura has broadened its offerings to include three tailored plans for individuals, couples, and families. These plans feature Aura’s advanced cybersecurity tools, such as antivirus software, VPN, and a password manager, providing strong protection against digital threats.

Aura pros and cons

Let’s examine the advantages and disadvantages of opting for Aura to protect your digital identity.

+ Pros

- Antivirus software across all plans

- Comprehensive identity theft protection and credit monitoring services

- Dark web monitoring

- Fraud call protection

- Up to $1 million in insurance coverage

- Plans for individuals, couples, and families

- Useful parental control app

- Password manager and VPN included

- 24/7 customer support and fraud resolution

- Transparent pricing

- 3-bureau credit monitoring included in all plans

– Cons

More expensive than some competitors

See the latest Aura prices and deals: https://aura.com/save-50-offers

Let’s now shift our focus to LifeLock.

LifeLock overview

LifeLock, now under Gen Digital Inc. since shedding its Norton LifeLock identity in 2022, has been a prominent figure in identity theft prevention since 2005. Despite facing challenges such as a significant merger with Norton 360 and a $12 million FTC fine in 2010 for deceptive advertising claims, the company has persevered.

LifeLock has also seen its share of drama, such as the departure of co-founder Robert J. Maynard, Jr. under a cloud of controversy. But like a phoenix rising from the ashes, LifeLock has not only survived but evolved, boosting its services and security measures.

Today, LifeLock maintains a robust Trustpilot score of 4.6, indicating a strong reputation among users. However, approximately 9% of reviewers have expressed dissatisfaction, awarding it the lowest rating. These critical voices point out issues with ID theft alert management, occasional technical problems, and less-than-ideal customer service experiences, including false alarms.

LifeLock pros and cons

Now, let’s delve into the strengths and weaknesses associated with choosing LifeLock for your digital identity safeguarding needs.

+ Pros

30-day free trial period

VPN included with family subscriptions

Full-service identity theft protection

Integration with Norton 360 antivirus for enhanced security

Insures up to $1 million in costs stemming from identity theft incidents

Intuitive user interface and straightforward setup process

Protection for lost wallets

- Easy-to-use mobile applications

– Cons

Monitoring from all three credit bureaus is reserved for the more premium plans

- The structure of the paid plans may be perplexing

Price increase after the first year

Steeper pricing compared to competitors

Is Aura or LifeLock more trustworthy?

This dedication to top-notch security boosts Aura’s credibility and trustworthiness among users. Notably, Aura maintains a clean track record without any security incidents or controversies, further solidifying its reputation. Meanwhile, LifeLock has seen its share of controversy and was fined previously for deceptive advertising.

Trustworthiness winner: Aura

Availability and insurance coverage: Does Aura or LifeLock offer more comprehensive protection?

If your identity is stolen, recovery can be costly, but identity theft insurance helps cover expenses like stolen funds, lawyer fees, and more. So, how do Aura and LifeLock compare?

| Aura | LifeLock | |

| Identity theft insurance amount | $1M for each adult member, up to $2M on the “Couple” plan, and up to $5M on the “Family” plan | $1M with all plans but only for lawyers and experts. Stolen funds and personal expenses vary from $25,000 to $1M, depending on the plan |

| Stolen funds reimbursement | Up to $1M | From $25,000 to $1M, depending on the plan |

Aura offers a comprehensive identity theft insurance policy that provides up to $1 million in coverage for each adult. If you’re part of a dynamic duo, you can enjoy an increased safety net of up to $2 million on couples plans, while families are embraced with up to $5 million on family plans. This includes a robust stolen funds reimbursement, with up to $1 million to help you bounce back if identity theft strikes.

See all Aura price plans here >

LifeLock, on the other hand, also offers identity theft insurance, but with a twist. The $1 million coverage primarily caters to the costs of lawyers and experts. When it comes to reimbursing stolen funds and personal expenses, the cap can start from $25,000, depending on your chosen plan.

See all LifeLock price plans here >

Aura’s watchful eyes don’t just skim the surface – they delve into the dark web, scrutinize data broker lists, and keep a watchful eye on public records and new account registrations, all to protect your personal details like your name, SSN, and address. It’s vigilant across multiple platforms, including Windows, macOS, and Android, and works seamlessly with browsers such as Chrome, Firefox, and Edge.

LifeLock’s system requirements cover Android, Mac, Windows, and iOS, and its Norton Safe Web browser extension is ready for action on Google Chrome, Mozilla Firefox, and Microsoft Edge browsers.

Comparing Aura and LifeLock reveals similar toolsets at comparable prices. Aura stands out as a comprehensive, all-in-one identity protection solution, while LifeLock caters to those focused on identity, credit, and financial monitoring, potentially without requiring additional digital security tools.

Availability and insurance coverage winner: Tie

Core identity protection capabilities: Who wins Aura and LifeLock face-off?

Aura and LifeLock both provide identity monitoring services, but they each offer different features. To make the right decision, it’s crucial to look at what each service offers for protecting your identity, like keeping an eye on your credit, watching for your info on shady parts of the internet, and guarding your bank accounts.

Credit monitoring across the bureaus

Aura’s basic plan includes three-bureau credit monitoring, offering a significant edge over LifeLock, which provides this feature only in its premium plans. Monitoring all three bureaus – Experian, Equifax, and TransUnion – is crucial because lenders might report different information to each, leaving gaps in protection if one is overlooked.

Both Aura and LifeLock notify users about new account openings and credit inquiries, key indicators of potential identity theft. However, Aura sets itself apart with a direct link to the credit bureaus, enabling quicker alerts and immediate responses to suspicious activities. In contrast, LifeLock’s setup and identity verification process may take several days before activation.

The speed of credit monitoring alerts is critical – delayed notifications can give fraudsters time to inflict more damage. Aura’s prompt alerts and comprehensive credit report access across all bureaus – even on their most affordable plan – make it a perfect choice for individuals keen on maintaining vigilant credit health and preventing identity theft.

In contrast, LifeLock’s tiered approach to credit monitoring might require an upgrade for those aiming for similar coverage, whereas Aura includes it as a standard feature.

Credit Monitoring Winner: Aura

Dark web surveillance

The dark web includes a part of the internet that is not indexed by search engines and is often used for nefarious activities, such as:

Compiling and selling personal information – Individuals’ sensitive data such as social security numbers, credit card information, and passwords are traded for illegal profits.

Trafficking illegal drugs and firearms – The dark web serves as a marketplace for the exchange of narcotics and weapons, circumventing legal restrictions and law enforcement.

Organizing cyber attacks and hacking activities – Hackers and cybercriminals plan and execute attacks on networks, systems, and data, often resulting in data breaches and ransomware dissemination.

Sharing explicit and illegal content – Distribution and access to illegal content, including pirated media and illicit materials banned on the surface web.

Dark web surveillance, therefore, is an indispensable component of identity theft protection services, acting as an early detection system for potential data leaks.

| Aura | LifeLock | |

| Where does it monitor for signs of fraud? | The dark web, data broker sites, public records, bank and investment accounts, online sites and discussion forums, payday loans, criminal and court records | The dark web, data broker registries, public records, bank and investment accounts, online sites and forums, payday loans, criminal and court records, and social media platforms |

| What can you add to your watchlist? | Your name, date of birth, address, up to 10 email addresses, 40 credit/debit card numbers, 5 phone numbers, 3 health insurance IDs, and more | Your name, date of birth, address, up to 5 email addresses, 10 credit/debit card numbers, 5 phone numbers, 5 health insurance IDs, and more |

| You’ll receive alerts for any suspicious activity? | Yes | Yes |

Aura monitors various platforms for identity threats, including the dark web, data broker sites, public records, and financial accounts. Customers receive detailed alerts about any issues, advice on how to address them, and access to expert help. Aura also allows users to check the dark web for their information at no extra cost.

LifeLock performs dark web surveillance, searching for compromised personal data. It monitors bank and investment accounts, payday loans, and criminal records. While the specifics of LifeLock’s alert system are less publicized, the promptness of alerts is critical in identity theft situations. Aura is noted for its fast alerts, which is a significant advantage when every second counts.

Dark Web Surveillance Winner: Aura

Financial and investment account safeguards

Let’s see how Aura and LifeLock stack up when it comes to watching over your finances and keeping your financial information safe.

| Aura | LifeLock | |

| Account monitoring? | Yes, complete account monitoring (credit cards, checking accounts, savings accounts investment accounts 401(k)s, and any changes to banking information) with all plans | Depend on the plan: None with the “Standard” plan”, limited with the “Advantage” and complete account monitoring with the “Ultimate Plus” plan |

| High-risk transaction alerts? | Yes | Yes |

| Lost wallet remediation | Yes | Yes |

Like a trusty sidekick, Aura includes extensive monitoring of credit cards, bank accounts, investments, and 401(k)s in all its plans, alerting you to any unusual transactions or changes to your banking details, and wrapping a security blanket around your finances.

LifeLock’s “Standard” plan acts as a sentinel, keeping watch without delving into the finer details of account monitoring – a feature that’s unlocked with the “Advantage” and “Ultimate” Plus plans. When it comes to wallet protection and alerts for high-risk transactions, LifeLock’s vigilance mirrors Aura’s, ensuring that your financial bulwarks are equally fortified.

Aura indeed provides a comprehensive suite of monitoring features in all its plans, which includes keeping an eye on transactions that might not be immediately visible on a credit report, such as payday loans. This approach guarantees that every subscriber, no matter their chosen plan, enjoys a high level of financial account security.

In contrast, LifeLock, though providing robust protection, mandates customers to select higher-tier plans for similar comprehensive monitoring. Thus, Aura emerges as the more encompassing choice for financial account security, starting from its base plan.

Account Safeguards Winner: Aura

Aura takes the lead in the identity protection race with its comprehensive credit monitoring from all three credit bureaus in every plan, vigilant dark web surveillance, and thorough financial and investment account safeguards. By providing these features, Aura offers a robust and all-encompassing defense against identity theft threats.

Core identity protection capabilities winner: Aura

Note: Some Aura vs LifeLock Reddit posts also discuss the big difference in features between these two services.

Additional digital defenses: Who offers better extras?

Both Aura and LifeLock deliver quality identity protection, but they also add valuable extras.

Parental controls and child identity monitoring

For families, the importance of parental controls and child identity monitoring can’t be overstated when picking out an identity theft protection service.

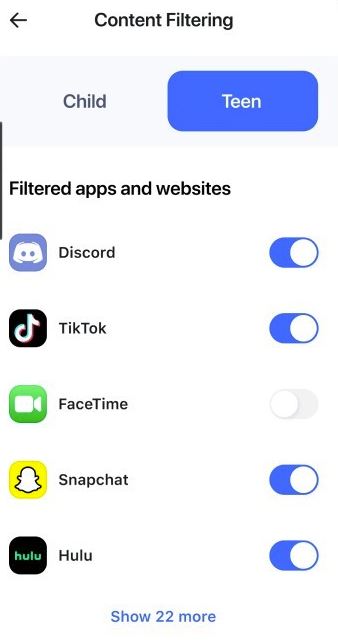

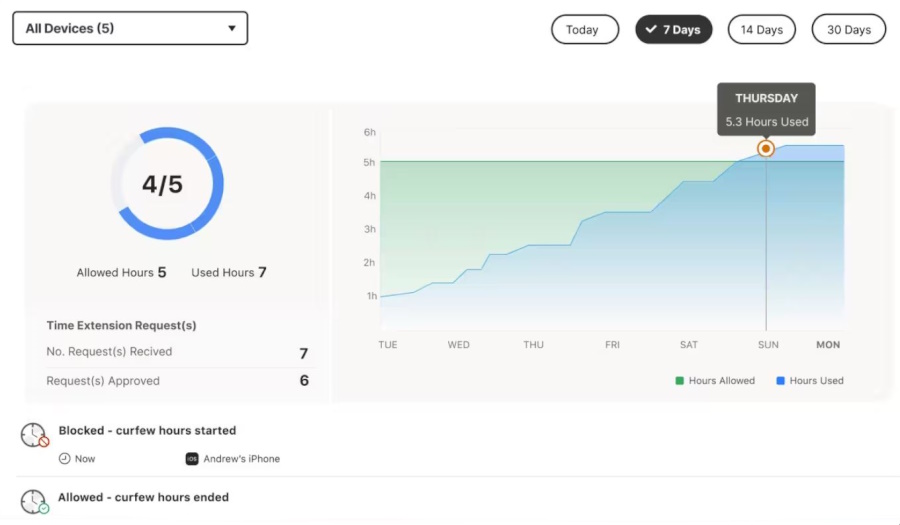

Aura takes this seriously, offering robust security features to keep your little ones safe online. Its parental controls act like digital guardian, giving parents the power to filter unsuitable content, manage screen time, and receive alerts about cyberbullying or online predators.

Aura’s Family plan wraps all these protective measures together, ensuring your kids can explore the internet securely.

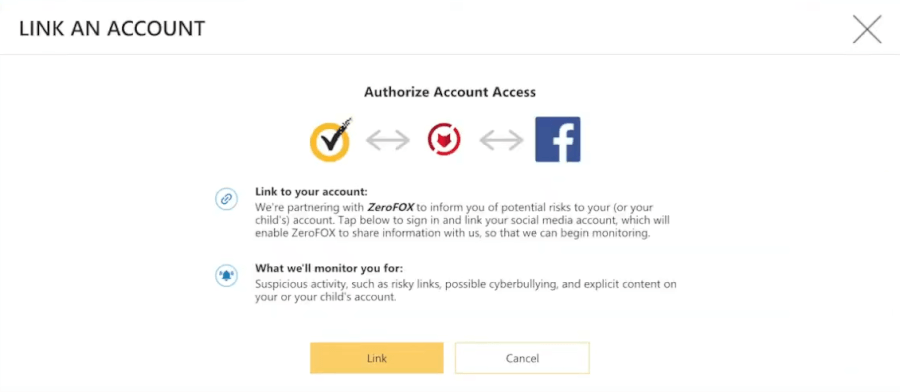

In the other corner, LifeLock’s family-focused plans zero in on safeguarding children’s identities, with a keen eye on their social media activities for any signs of fraud. But, when it comes to the nuts and bolts of parental controls, LifeLock takes a step back, leaving out those specific features.

While both services aim to protect children, their feature depth varies, affecting how well they guard against identity theft.

Parental controls and child identity monitoring Winner: Aura

Antivirus and VPN protection

In the digital age, robust antivirus and VPN protection are not just beneficial – they’re essential.

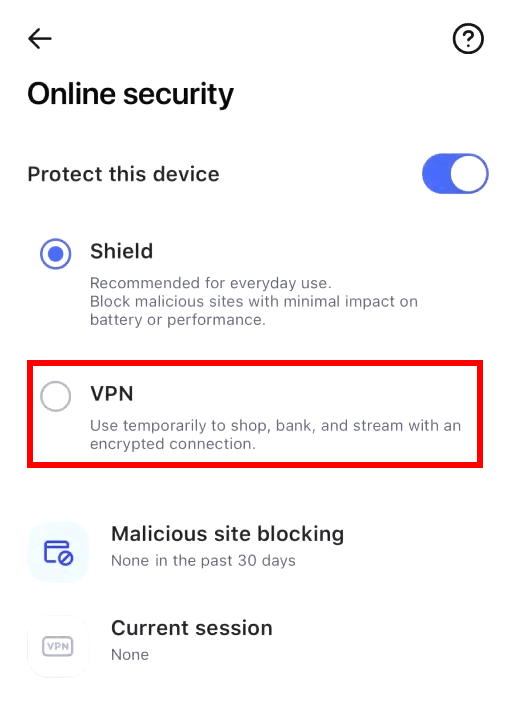

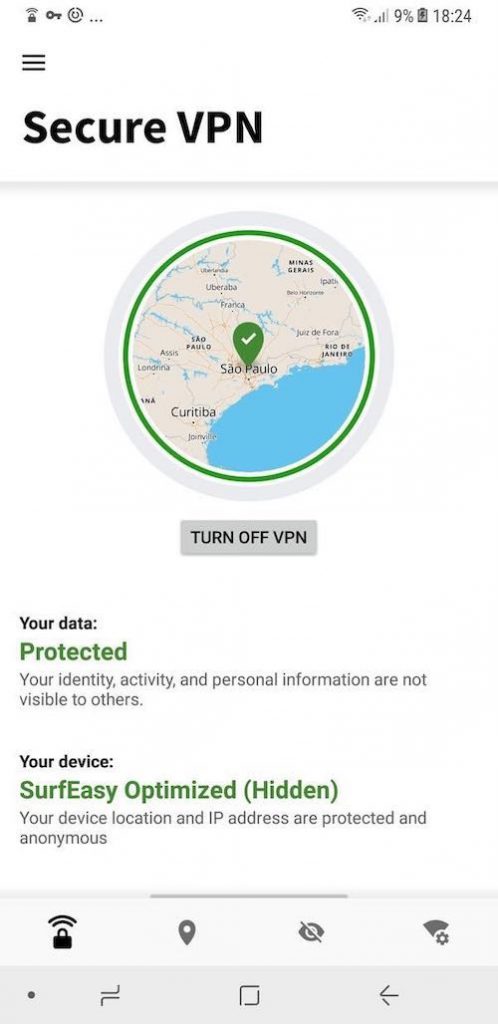

Aura delivers in this area as well. Below is a screenshot of Aura’s VPN service.

Aura acknowledges this necessity by incorporating these critical security measures into all their plans. Users can confidently browse the web, secure in the knowledge that Aura’s comprehensive safeguards are in place to protect their sensitive information from emerging cyber threats.

LifeLock, on the other hand, offers Norton 360 device protection, which includes antivirus and VPN services, as an additional purchase. This approach allows users to enhance their digital security, but at an extra cost. While this provides flexibility, it also means that for full protection, LifeLock customers may face higher overall expenses, which is an important consideration when evaluating the service’s value.

Aura takes the crown in the antivirus and VPN protection category, bundling these essential security features into all its plans at no extra cost, ensuring users are shielded against cyber threats as part of their standard package.

Winner: Aura

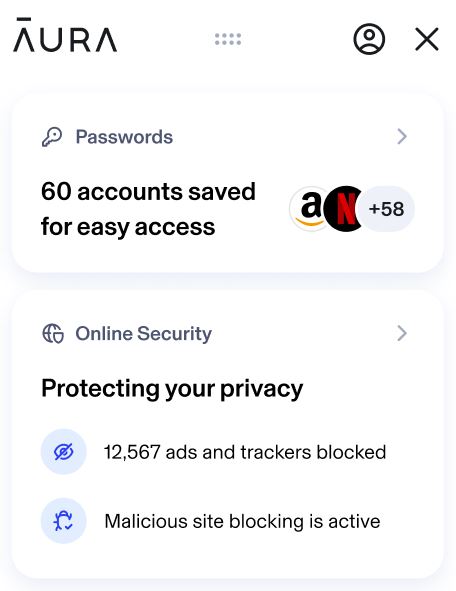

Ad and tracker blocking

Aura offers an ad and tracker-blocking browser extension that’s a breeze to use on popular browsers like Chrome, Firefox, and Edge. This steps up your privacy game on your digital devices. The browser extension does more than just block those pesky ads – it also comes with a password manager and email masking to keep your online identity under wraps.

But keep in mind, since it’s browser-based, pairing it with a VPN that also blocks ads might give you a more ironclad defense. Also, a minor hiccup is that you might run into some extra verification steps during activities like Google searches, which can take a tad longer, but it’s a small price to pay for added security.

LifeLock, which comes with the Norton add-on for those willing to invest a bit more, unfortunately doesn’t pack an ad blocker for most platforms. Norton’s ad blocker for iOS does a decent job filtering ads on Apple devices, but it doesn’t catch DNS-level ads, so some might slip through the cracks, like those annoying ads on YouTube.

Winner: Aura

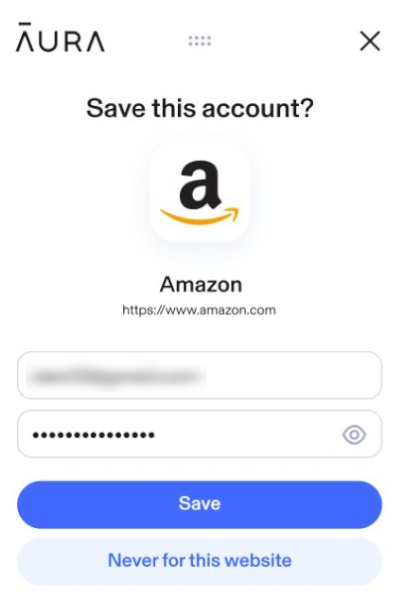

Password manager

Aura outfits each of its plans with a user-friendly password manager, boosting your online defenses by keeping an eye out for compromised or weak passwords. It streamlines your digital life, too, by automating password updates on select websites, making it a breeze to keep your accounts locked tight.

LifeLock, meanwhile, steps back from including a password manager in its identity protection packages. That said, Norton password manager is available as a standalone free option. While it’s handy, it doesn’t mesh with LifeLock’s monitoring services, which could lead to a less cohesive user experience when juggling different security tools.

Winner: Aura

Social media account monitoring and alerts

LifeLock shines when it comes to keeping your social media realms secure. It promptly alerts you to unusual activities such as unauthorized changes to account settings or the sharing of suspicious links, thus ensuring a higher level of security for your online presence. Plus, it’s got your kids’ backs too, watching over their social media use and flagging potential cyberbullying or those viral challenges that can sometimes go too far.

Aura may not have a feature to specifically monitor social media fraud alerts, but it does pack a punch with its all-in-one parental controls. While LifeLock focuses on social media safety, Aura offers comprehensive protection for the whole family, guarding against personal data breaches and financial scams.

Winner: LifeLock

In the end, Aura emerges as the victor in this head-to-head battle, thanks to its comprehensive inclusion of additional digital defense features such as robust parental controls, antivirus, VPN protection, and ad and tracker blocking in all its plans at no extra cost.

Additional digital defenses winner: Aura

Ease of use and support: Is Aura or LifeLock more user-friendly?

Choosing an identity theft protection service should be straightforward. Aura and LifeLock both offer help, but consider which one is easier to use. A simple service with helpful support can make managing your identity protection less stressful.

We’ll examine both contenders in the following sections to see which one better meets these criteria.

Setting up your protection

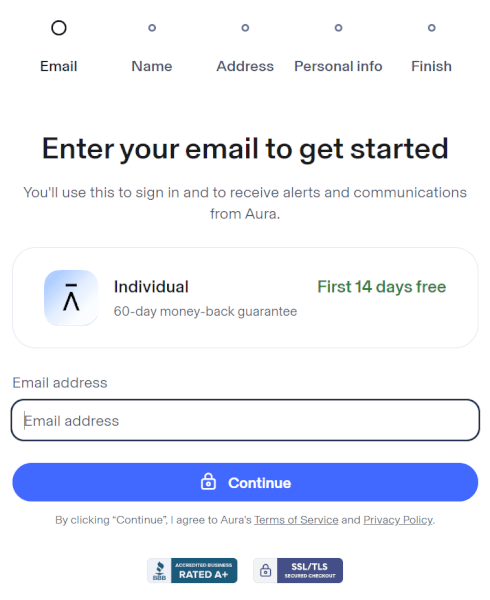

The signup process is a crucial first step when choosing an identity theft protection service. Aura makes this process straightforward on its website, guiding users to pick a subscription plan and provide key details like name, email, and phone number with ease.

The user-friendly interface leads you through a smooth registration, swiftly setting up Aura’s security features, including VPN, antivirus, and browser extensions that bolster your online safety with password management and ad blocking.

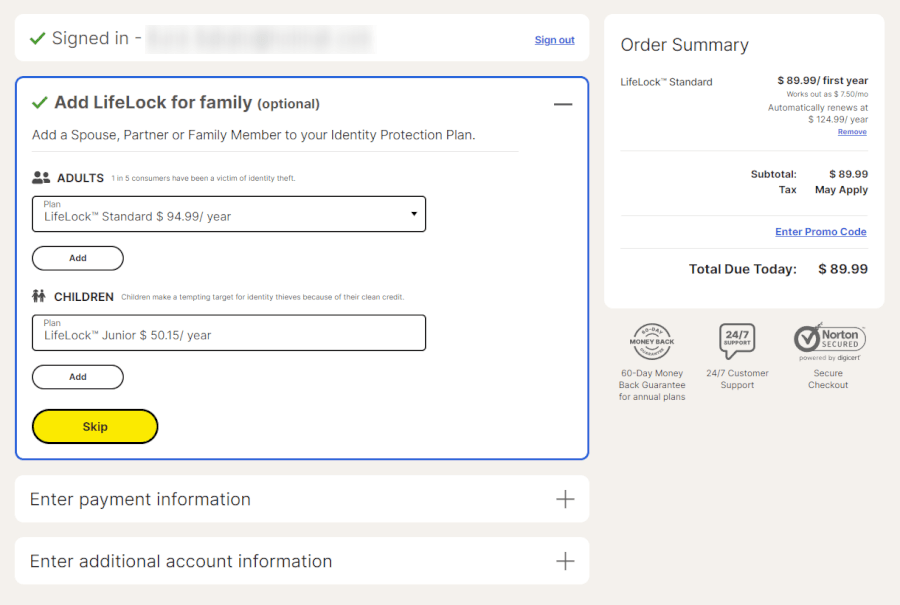

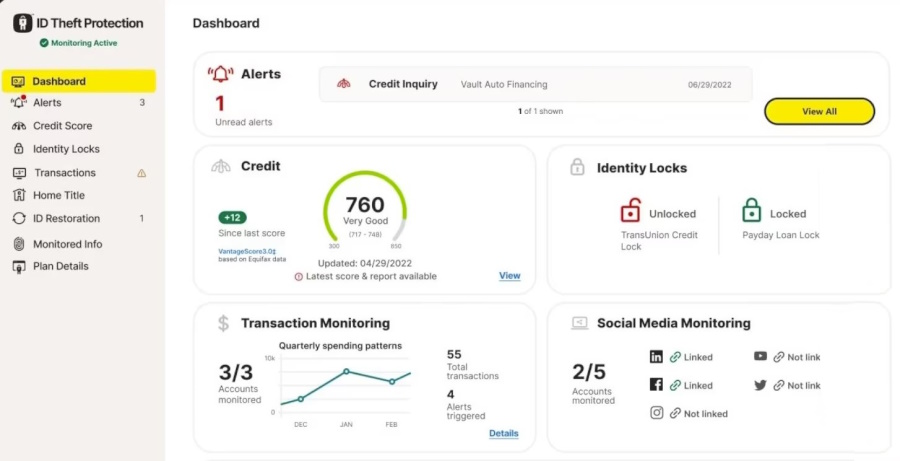

On the other hand, LifeLock’s signup requires a bit more detail, asking for comprehensive personal and financial information to tailor the monitoring to your needs. Once you’ve entered your billing details, you’ll have access to LifeLock’s dashboard, where you can manage your settings and stay informed with security alerts about your personal information.

Aura consistently earns positive remarks for its intuitive interface, which is accessible on various devices such as Windows, Mac, iOS, and Android. LifeLock’s service is also available across these platforms, though some users point out that LifeLock’s user experience may not be as streamlined as Aura’s, with a bit more effort needed to navigate its features and dashboard.

Winner: Aura

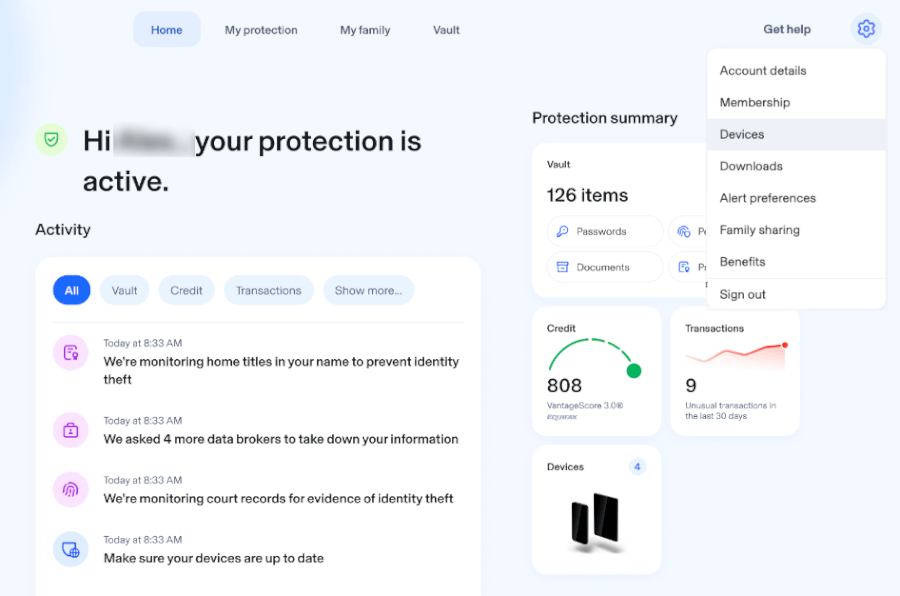

Navigating your dashboard and apps

Aura’s app, available for iPhone and Android, offers a clean and easy experience for managing your accounts and monitoring your financial activities. Aura’s desktop application serves as a one-stop security hub, empowering you to tailor your dashboard for a personalized snapshot of your digital security health.

LifeLock’s dashboard is user-friendly and thoughtfully designed, but it may require a few days after sign-up to fully activate credit monitoring features, which could delay your immediate access to some of the service’s key offerings. Although LifeLock’s mobile apps score high on user-friendliness, having two separate apps might initially puzzle users as they figure out which one to download.

Aura’s intuitive interface and seamless navigation across devices edge out LifeLock, providing users with a more straightforward and stress-free experience.

Winner: Aura

Customer support and resources

Both Aura and LifeLock offer 24/7/365 customer support, ensuring that help is always at hand. Aura boasts a US-based support team, ready to provide digital security consultations at any time. In the event of identity theft, Aura assigns skilled case managers to work with you directly.

LifeLock also offers 24/7/365 support, but with an overseas support team. For those subscribed to the Ultimate Plus plan, LifeLock offers “priority” support. LifeLock’s case managers, like Aura’s, are based in the US and are committed to guiding victims of identity theft through the resolution process.

Each contender provides reliable customer service, but Aura has an edge with US-based support.

Winner: Aura

With its intuitive design, simple setup, and round-the-clock customer support, Aura takes the crown for ease of use and support, offering users a seamless and stress-free journey in safeguarding their identities.

Ease of use and support winner: Aura

Financial health: Who offers more helpful credit reports and scores?

Maintaining sound financial health is paramount, and both Aura and LifeLock offer tools to assist with credit report and score management.

Aura includes three-bureau credit monitoring across all plans, with monthly credit score updates and an annual credit report to help users monitor their credit status. However, Aura’s service doesn’t provide credit simulators or financial planning calculators, and credit reports are issued only once a year.

LifeLock’s premium plan offers monthly credit reports and daily credit score updates from all three principal credit reporting agencies, in addition to the option to secure your TransUnion credit file. This control is pivotal when applying for new credit or loans, allowing users to lock or unlock their credit files as needed.

However, the lower-tier plans of LifeLock offer more basic monitoring, limited to one credit bureau and sometimes without free credit reports. Users with these plans may need to independently freeze or lock their Experian and Equifax credit files for full protection.

Financial health reports winner: Tie

Security and privacy: Is Aura or LifeLock a safer choice?

When it comes to keeping your personal info under lock and key, both Aura and LifeLock are in the spotlight, but they’ve taken different paths to safeguard your data.

Aura wraps your details in the same level of encryption that banks and the military trust – a pretty solid vouch for security. They’ve also teamed up with big names like Walmart and Bank of America, which says a lot about the confidence these giants have in Aura’s defenses.

LifeLock, on the flip side, has had a couple of bumps in the road with the FTC due to data protection mishaps – not once, but twice. It was a wake-up call that had everyone, including the FTC Chairwoman Edith Ramirez, talking about the need for ironclad security.

Both Aura and LifeLock need to peek into your personal info to keep an eye out for threats. Aura’s got a strong track record with top-tier encryption, while LifeLock has been working hard to tighten up its act since the FTC stepped in.

In a nutshell, while Aura and LifeLock both promise to shield your data, their track records and commitment to data protection can sway you one way or the other when it comes to feeling secure and keeping that trust meter ticking.

Security and privacy winner: Aura

Plans and pricing: Does Aura or LifeLock offer greater value for money?

Cost-effectiveness is a key factor when selecting an identity theft protection service.

- Individual Plan: This plan is perfect for single users, priced at

$12 monthly($9/mo. with coupon) when billed annually. It encompasses $1 million in identity theft insurance, 1GB of secure cloud storage in the Vault, and comprehensive security for up to 10 devices. - Couple Plan: Ideal for two users, this plan is available at

$22 per month($17/mo. with coupon) with annual billing. It includes the same $1 million insurance coverage for identity theft, doubles the cloud storage to 2GB, and extends device security coverage to 20 devices. - Family Plan: Designed with families in mind, this plan is priced at

$37 per month($25/mo. with coupon) when billed annually. It significantly increases the insurance coverage to $1 million per adult, provides a generous 5GB of cloud storage space, and secures up to 50 devices.

Aura’s transparent pricing policy ensures that customers receive a comprehensive solution without the need for additional purchases or unexpected upsells, and new subscribers can take advantage of notable savings.

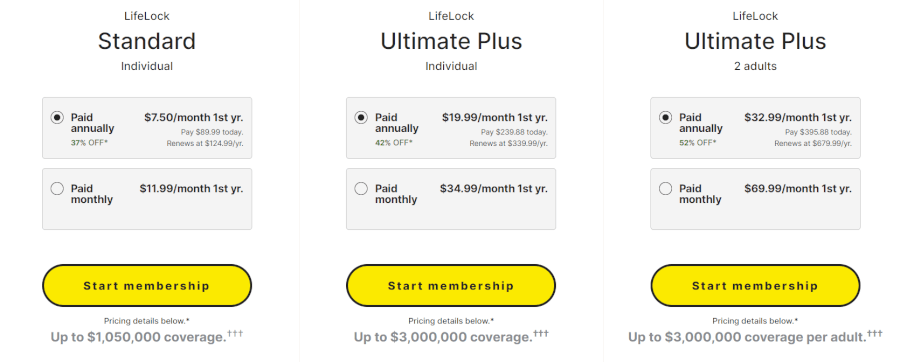

LifeLock’s pricing approach is more intricate, with its “Standard”, “Advantage”, and “Ultimate Plus” plans starting at promotional rates for the first year, followed by up to 45% increase upon renewal.

LifeLock matches Aura’s 60-day money-back guarantee for annual subscriptions. However, integrating Norton 360 device protection and VPN services incurs an additional monthly charge. For perspective, the annual cost for LifeLock “Ultimate Plus” for an individual is initially $239.88, but this amount escalates to $339.99 per year at the time of renewal.

See all LifeLock prices here >

Aura takes the crown in the plans and pricing round.

Plans and pricing winner: Aura

Conclusion: Who’s the clear winner?

When weighing up Aura and LifeLock for identity protection, there are a few key points to consider. Here’s a brief rundown of how each service stacks up in the areas we looked at:

Trustworthiness: Aura

Availability and insurance: Tie

Core identity protection capabilities: Aura

Additional digital defenses: Aura

Ease of use and support: Aura

Financial health reports: Tie

Security and privacy: Aura

Plans and pricing: Aura

Ultimately, both Aura and LifeLock are reputable and offer similar features, but Aura stands out for several reasons. Even its basic plan includes comprehensive identity and credit monitoring, coupled with superb online safety tools at no extra cost. This makes Aura a solid choice, especially for budget-conscious users.

Exclusive Aura Coupon:

Get 68% Off Aura subscription plans with the coupon below:

(Coupon is applied automatically; 60 day money-back guarantee.)

If you want to give LifeLock a shot, you will also benefit from a 60 day money-back guarantee.

Identity theft protection reviews on RestorePrivacy:

- Aura vs Experian IdentityWorks

- Aura vs IDShield

- Aura vs McAfee

- LifeLock vs IDShield

- Aura vs Incogni

- Aura vs IdentityIQ

- Aura vs IDShield

- Identity Guard vs Aura

- Identity Guard vs LifeLock

- LifeLock vs Experian Identity Works

Aura vs LifeLock FAQ

Is Aura or LifeLock better?

Aura stands out as the preferred choice over LifeLock for identity theft protection. LifeLock, under the Norton umbrella, offers a wide range of security products, each with its own cost – a factor that can strain a monthly budget.

Aura, on the other hand, has adopted a more consolidated approach by including essential features like antivirus, VPN protection, and credit monitoring in one service. This integration simplifies the user experience and offers better value by eliminating the need for multiple subscriptions and associated costs.

Do both Aura and LifeLock offer three-bureau credit monitoring?

While Aura provides three-bureau credit monitoring across all its plans, LifeLock reserves this feature for its premium subscribers. So if full-spectrum credit monitoring is on your must-have list, Aura is your go-to.

Do Aura and LifeLock offer antivirus and VPN protection?

Yes, Aura certainly does include antivirus and VPN protection in all of their plans, which is quite convenient. On the flip side, with LifeLock, you’ll need to make an additional purchase to get Norton 360 device protection, which comes with antivirus and VPN services.

This Aura vs LifeLock comparison guide was last updated on July 21, 2024.

Leave a Reply