In a world where digital security is paramount, you’re likely asking yourself does Aura Identity Theft Protection work? As we navigate the treacherous waters of the internet and data breaches, identity theft has become a sophisticated and rampant enterprise. Safeguarding personal information is more critical than ever.

Our extensive, no-nonsense Aura review will meticulously dissect all its features. We will scrutinize the pricing structure and evaluate the ease of use against the backdrop of the most common online threats.

From phishing scams that bait you into giving up sensitive information, to malware that stealthily infiltrates your devices, and the perilous unsecured Wi-Fi networks that beckon with convenience – our review covers how Aura stands its ground against these pervasive dangers.

With a keen eye for detail, our expert team has thoroughly tested this service. We have explored every nook and cranny to provide you with a detailed and comprehensive analysis. Armed with this knowledge, you’ll have the insight needed to make an informed decision about how to restore and protect your digital privacy.

Key takeaways from testing Aura

- Aura offers a robust array of tools for identity theft and fraud protection, including monitoring of personal and financial data, antivirus, VPN, password manager, parental controls, and up to $1 million in insurance for eligible identity theft losses.

- The service boasts an intuitive user interface, simple setup, and 24/7 customer support, along with US-based fraud resolution specialists, enhancing the user experience across both desktop and mobile platforms.

- Aura offers very competitive pricing and a 60-day money-back guarantee on annual plans, providing a cost-effective solution with comprehensive features that rival services like LifeLock and Zander.

Exclusive Aura Coupon:

Get 68% Off Aura subscription plans with the coupon below:

(Coupon is applied automatically; 60 day money-back guarantee.)

Aura pros and cons

Let’s take a look at the pros and cons of choosing Aura Identity Theft Protection to safeguard your online privacy.

+ Pros

- Antivirus software across all plans

- Comprehensive identity theft protection and credit monitoring services

- Dark web monitoring

- Fraud call protection

- Up to $1 million in insurance coverage

- Plans for individuals, couples, and families

- Useful parental control app

- Password manager and VPN included

- 24/7 customer support and fraud resolution

- Transparent pricing

- 3-bureau credit monitoring included in all plans

– Cons

More expensive than some competitors

See the latest Aura prices and deals: https://aura.com/save-50-offers

Aura identity theft protection features overview

Before we dive into details, here’s a snapshot of what Aura Identity Theft Protection brings to the table:

Robust identity monitoring toolkit – Aura provides extensive monitoring of personal and financial information to detect potential identity theft.

- Credit monitoring with yearly credit reports – Continuous surveillance of credit files from three major credit bureaus to alert users to changes and inquiries.

- Fraud calls protection – Aura includes measures to protect against spam calls, enhancing user security.

- Identity theft insurance – Up to $1 million in insurance coverage for expenses related to identity theft incidents.

- 24/7 customer support – Round-the-clock assistance available for general inquiries and urgent identity theft cases.

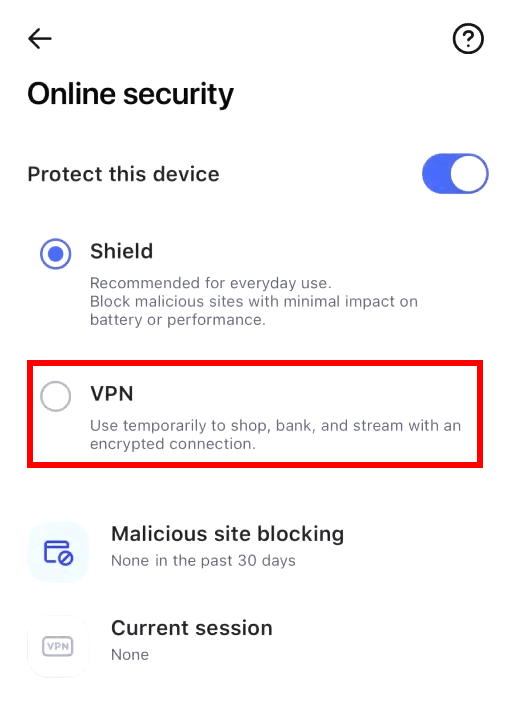

- Built-in VPN service – Secure VPN service across multiple devices to maintain user anonymity and online privacy.

- Password manager – A tool that securely stores passwords and alerts users to compromised accounts and weak passwords.

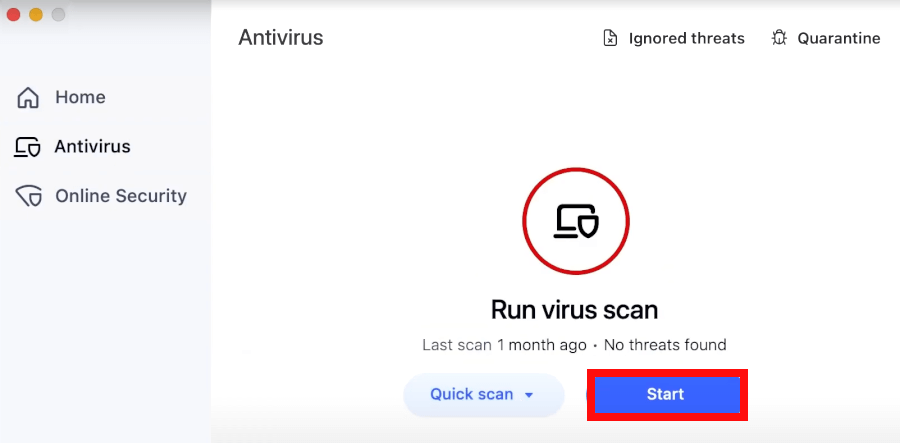

Antivirus – Comprehensive antivirus software that protects against malware and other cyber threats.

- Dark web monitoring – Scans the dark web for personal information leaks and alerts the user if their data is compromised.

- Financial transaction monitoring – Monitors linked credit, banking, or investment accounts for fraudulent activities.

- Experian CreditLock – Allows users to lock their Experian credit report to prevent unauthorized access (exclusive to Experian).

- Lost wallet remediation – Aura assists with the rapid cancellation of lost debit or credit cards and develops a recovery plan to secure your identity.

- 60-day money-back guarantee – The 60-day money-back guarantee is exclusive to annual subscriptions, offering confidence in your long-term investment.

What Aura is and how does it work?

Aura offers a user-friendly platform engineered to shield your personal and financial information from the myriad of online threats, such as identity theft. By proactively scanning various channels, which include the dark web, financial transactions, and social media activities, Aura ensures a robust defense against the unauthorized exploitation of your data.

Alongside its vigilant monitoring, Aura equips you with a secure VPN service for safe internet use across your devices and top-notch antivirus software to keep malware at bay.

I found the onboarding process with Aura to be smooth and hassle-free. After signing up, you can manage your account through their mobile app, which is compatible with both iPhone and Android devices. Aura keeps you in the loop with mobile alerts, so you’re always the first to know about any unusual activity or if your personal details are spotted on the dark web.

To ensure you’re fully protected, Aura requires you to provide comprehensive personal information during your initial profile setup. This is a crucial step as it enables Aura to monitor your data meticulously and notify you instantly if any part of your personal information is at risk of being compromised. Additionally, Aura offers a robust $1,000,000 insurance policy to provide financial relief in the unfortunate event that you fall victim to identity theft.

Company background: Can we trust Aura?

Aura’s journey began in 2014, when Hari Ravichandran created the company out of a personal need for a comprehensive digital security solution, having experienced the violation of credit information theft firsthand. Since then, Aura has been on a mission to offer a seamless and integrated safety solution that demystifies digital security for its users. With a global reach and serving over a million members, Aura has been steadfast in its pursuit to make the internet a safer place.

Hari Ravichandran, the Founder and CEO of Aura, emphasizes the company’s guiding principle:

“We aim to provide an all-in-one intelligent safety solution that’s both simple to grasp and effortless to use.”

Aura’s commitment to high-quality identity protection is recognized by many. It has received awards from Mom’s Choice Awards, Inc. Magazine, and Forbes. It also has a high TrustScore of 4.7 out of 5 on TrustPilot from 523 reviews, showing its dedication to customer happiness and service quality.

With the strategic purchase of Identity Guard, Aura now offers three specialized plans for identity theft protection tailored to individuals, couples, and families.

Core Features: What do you get with Aura?

Aura’s identity theft protection service is engineered to counteract the myriad of digital threats online. With prompt fraud alerts from credit and identity monitoring, Aura outpaces competitors, enabling swift action against identity theft. Its comprehensive dark web monitoring scours the internet’s hidden areas for any signs of your personal information.

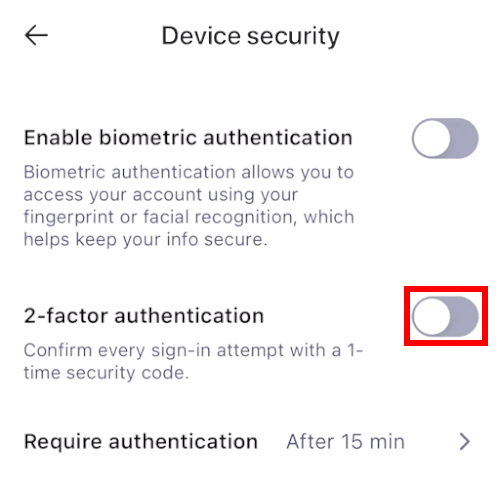

Aura vigilantly monitors your credit across all major bureaus and keeps an eye on your bank and investment accounts for signs of fraudulent activity. It even extends protection to your home and personal property titles. Two-factor authentication and enhanced malware defense are among the additional measures that fortify your digital security cocoon.

Let’s explore how each of these features contributes to your digital safety net.

Credit monitoring and reporting

Aura’s three-bureau credit monitoring is akin to having a personal bodyguard for your financial health. Here’s what you can expect from this vigilant feature:

Continuous watch over your credit reports: Aura keeps an eagle eye on your credit reports from all three major credit bureaus – Equifax, Experian, and TransUnion – ensuring nothing slips by unnoticed.

- Comprehensive coverage for peace of mind: With Aura’s extensive credit monitoring, you’re covered from all angles. Any changes or inquiries made to your credit files are detected swiftly, so you’re always in the know.

- Near real-time monitoring for immediate action: The moment something fishy pops up on your credit report, Aura sends you an alert. This prompt notification system empowers you to act quickly to prevent potential fraud.

Aura offers a suite of tools that empower users to take charge of their financial well-being. You’ll receive regular monthly credit scores and an annual credit report, helping you stay on top of your financial habits. Yet, it’s important to note a slight gap in this shield of protection – credit reports are available just once a year, and the service doesn’t include credit simulators or financial planning calculators.

Aura’s dashboard offers a straightforward interface for:

- Accessing and reviewing credit information with ease, ensuring you’re always informed about your financial standing.

- Consistently monitoring your credit status, providing a detailed view of your credit health.

- Utilizing Experian CreditLock for enhanced security, allowing quick prevention of unauthorized credit report access.

- Receiving timely alerts on financial transactions that could signal identity theft, enables you to take prompt protective measures.

Overall, Aura’s service serves as a proactive measure, equipping you with information and control over your financial health.

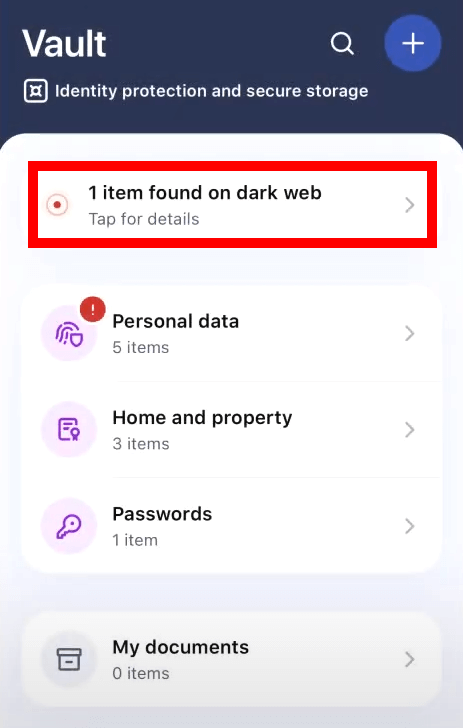

Dark web monitoring

The dark web, a shadowy corner of the internet notorious for the unauthorized trading of personal data, is under constant surveillance by Aura’s dark web monitoring. This proactive threat intelligence is a cornerstone of identity theft protection, alerting you to address data breaches swiftly.

Accessing the dark web monitoring panel is equally easy. It’s all right in the user settings dashboard as you can see below.

Aura’s advanced dark web monitoring tools comb through thousands of sites daily, scouring for any trace of your personal information across obscure forums and marketplaces. Should your details emerge, Aura promptly alerts you, enabling you to take immediate action to secure your accounts and prevent misuse.

Aura’s dark web monitoring service includes:

- Proactive threat intelligence to identify data leaks quickly.

- Daily scans of the dark web, ensuring no stone is left unturned.

- Alerts that prompt immediate action, such as changing passwords for compromised accounts.

- They’re monitoring for signs of tax refund fraud, which can be an indicator of identity theft.

- Tools for discreet web navigation to protect your privacy in the aftermath of a data leak.

- Automatic data broker removal services systematically erase your leaked information from unauthorized platforms.

Aura’s Dark Web monitoring is your digital guardian angel, tirelessly protecting your privacy from the shadows of the internet.

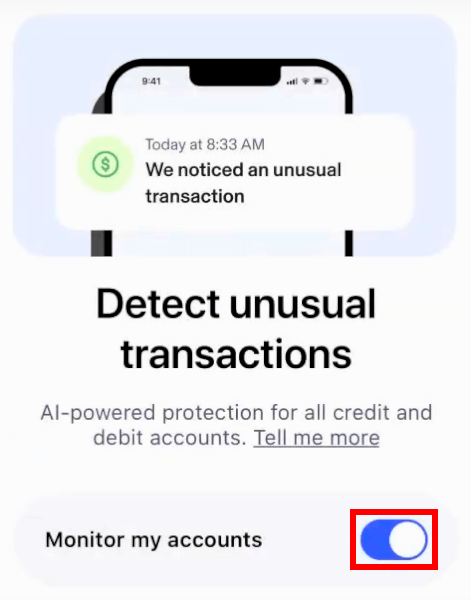

Bank and investment account monitoring

As financial fraud and identity thefts climb, the need for robust credit monitoring is critical. Aura meets this challenge by offering strict monitoring of financial activities across the three major credit bureaus – Equifax, Experian, and TransUnion. It vigilantly checks for new loans or credit cards potentially opened under your or your child’s names and keeps an eye on existing accounts for unauthorized transactions.

Aura’s services encompass investment and bank account monitoring, detecting fraudulent activities, and allowing transaction limits to be set. This includes checking, savings, retirement, and credit card accounts, fortifying your financial fraud defenses.

Secure account linking is facilitated through Plaid, ensuring safe connections. The Aura app permits easy account connections, alert configurations, and Wi-Fi network security features, protecting users from identity theft in all financial aspects.

Should suspicious activity arise, Aura’s credit monitoring tool enables users to lock their bank accounts quickly, protecting against hackers or other threats. Additionally, regular credit score updates and annual reports help users monitor their financial habits and stay alert to risks.

Insurance and resolution services

In the event of identity theft, Aura’s robust protection plan comes with a $1,000,000 insurance policy for each adult member. This substantial policy is crafted to help you recover from the financial impacts of identity theft, covering a broad spectrum of costs, from the funds stolen to legal fees and even travel expenses.

It’s important to note, though, that this insurance doesn’t cover individuals under the age of 18. To benefit from this coverage, members must provide proof of their direct losses and related expenses, which Aura will assess for reimbursement under the policy’s terms.

Aura’s commitment to your peace of mind doesn’t stop at financial compensation. Their white-glove service goes the extra mile to support members affected by identity theft, offering:

Personalized assistance from dedicated resolution agents who specialize in white-glove fraud resolution services, ensuring that you receive expert care and attention as you navigate through your case.

A custom recovery plan, crafted to address your situation and guide you through resolving issues with credit bureaus and government agencies.

Detailed, step-by-step support throughout the entire process of working with credit bureaus and legal authorities to help restore your identity, with a dedicated agent to help you through the intricacies of getting your identity back.

Ultimately, Aura offers a robust and user-centric approach to digital security, making it a strong ally in the fight against identity theft.

Device and network security

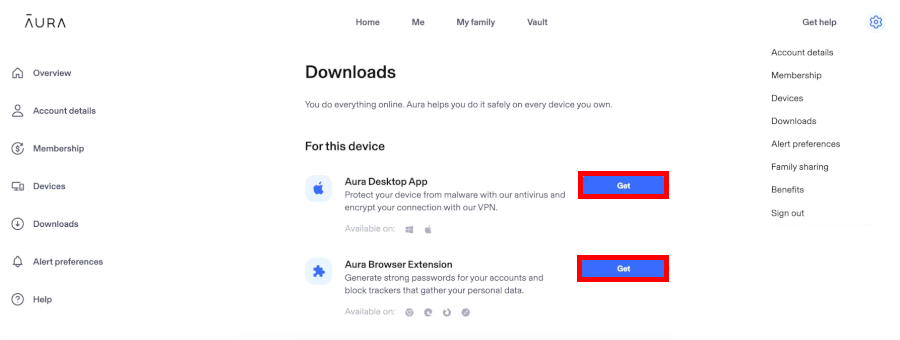

Recognizing the integral role of device and network security in comprehensive identity protection, Aura provides protection against malware with its antivirus software across all plans. In addition to this, Aura offers a VPN service, which they state is a no-logs VPN service (no data collected). That said, it would bolster confidence if the service was audited, as we’ve seen with ExpressVPN and NordVPN.

Enabling 2-factor authentication is as easy as a click of a button, as you can see below.

To further enhance user security, Aura includes:

- Password manager – A tool that not only securely stores passwords but also proactively alerts users to compromised accounts and weak passwords, helping to maintain strong account security.

Two-factor authentication – An additional security layer that requires a second form of verification, greatly reducing the likelihood of unauthorized access.

Advice on authenticator apps – Guidance for users on how to switch to authenticator apps for more secure two-step verification, especially after a data breach has occurred.

Note: You can enable 2-factor authentication via email or text, but make sure you have access to your phone or email to complete the setup.

Aura’s security extras

Aura Identity Theft Protection stands as a formidable shield in the digital age, providing a robust defense against the ever-evolving threats of identity theft and cybercrime.

Advanced ad and tracker blocking

Aura elevates your web experience by eliminating distractions and preserving privacy with its advanced ad and tracker-blocking technology. Install the Aura browser extension to block digital tracking. It’s compatible with Chrome, Firefox, and Edge, ensuring protection across devices.

One drawback with this type of ad-blocking is that it relies on an extension within the browser. If you use a VPN ad-blocker, however, it will seamlessly protect all browsers and apps from ads and tracking.

The ad-blocker extension also safeguards against online scams and phishing, and blocks malicious websites from harming your device with malware.

One caveat of the Aura extension is the occasional verification prompts. We noticed this with activities like Google searches, which may slow down online research and be slightly annoying.

Secure VPN service

Aura’s VPN service is a cornerstone of its digital security suite, enveloping your internet connection in robust AES-256 encryption, a gold standard among security experts, to maintain privacy, especially on public Wi-Fi. Despite being based in the US, a Five-Eyes country, Aura’s strict no-logs policy ensures your browsing habits remain private, preserving your anonymity.

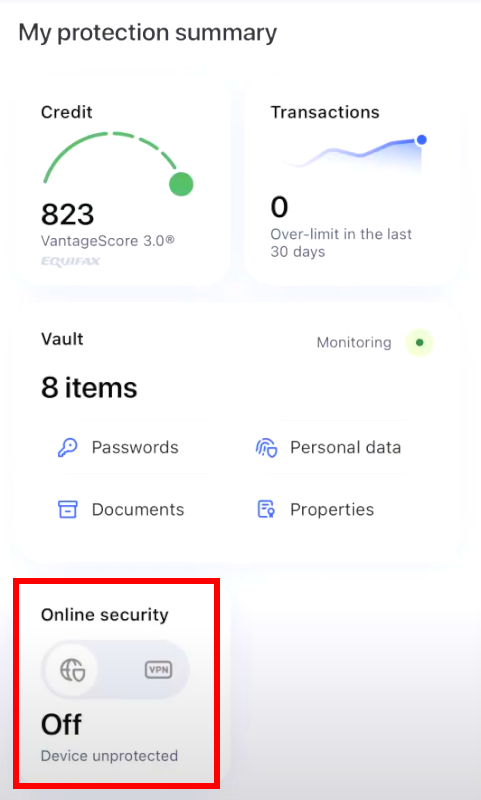

You can enable Aura’s VPN by logging into the app, scrolling down to “Online security”, checking both “Shield” and “VPN”, and toggling the switch next to “Protect this device”. You can see this in the screenshot below.

Unfortunately, the VPN restricts you to a US location without server options. If you want a larger server selection, consider using Surfshark or NordVPN.

Note: For detailed information on how Aura handles your personal data, you can refer to their privacy policy.

Advanced antivirus with AI technology

Aura’s antivirus, enhanced with AI, ensures safe browsing on Windows PC, macOS, and Android. The antivirus, a separate download, is easy to install and operates in the background, scanning and removing malicious software like viruses, ransomware, spyware, and trojans.

Vault for secure storage

Aura equips each adult member with 1 GB of secure cloud storage in the Vault, a virtual safe space for your crucial documents and passwords. This vault isn’t just for grown-ups – it also lets you set up profiles for your kids, fostering a secure online playground for them.

Meanwhile, Aura’s password manager acts like a trusty sidekick, taking the burden of remembering an endless list of login details off your shoulders. As you surf the web, it seamlessly stores your credentials, and retrieving them is just a tap away on the mobile app or a click on the Aura Chrome extension.

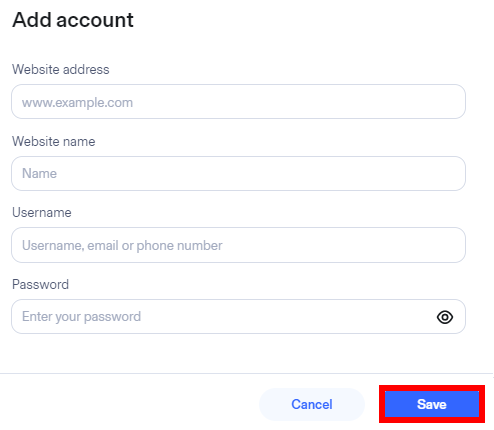

Quick Tip: To add a password to your vault, you’ll need to input the website address, website name, username, and password. Once completed, click on “Save” as you can see below.

Aura’s password manager is vigilant, too. It’s regularly checking the strength of your passwords, flagging any that have been compromised, and guiding you through updates with ease.

Comprehensive child protection tools

With the Aura Family plan, you’re equipping your household with a robust digital ally. Aura’s suite of child protection tools offers parents extensive control over their kids’ online presence, ensuring a safe digital environment.

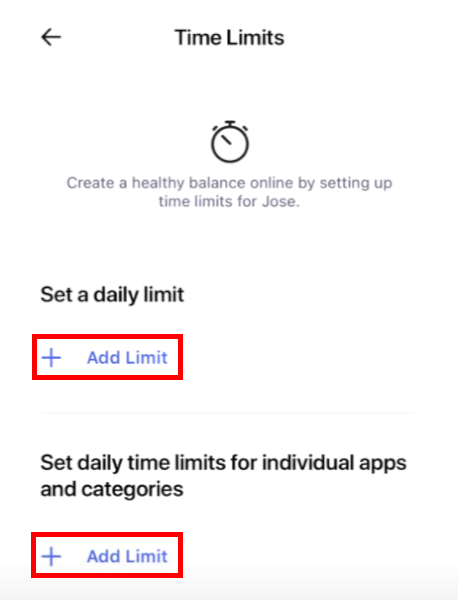

By integrating the Aura app across your family’s devices, you create a unified front against inappropriate content and online risks. As you can see below, you can set sensible screen time limits, pause internet access during family time, and keep a watchful eye on your children’s online interactions to defend against cyberbullying and online predators.

These are real concerns in our increasingly connected world, and Aura’s vigilant measures reassure you and control you need to ensure your children’s online experiences are safe and positive.

Ease of use: Are Aura’s apps easy to use?

In testing out Aura over the course of a few weeks, I found the desktop and mobile interfaces are intuitive, simplifying the management of security features.

User interface and initial setup

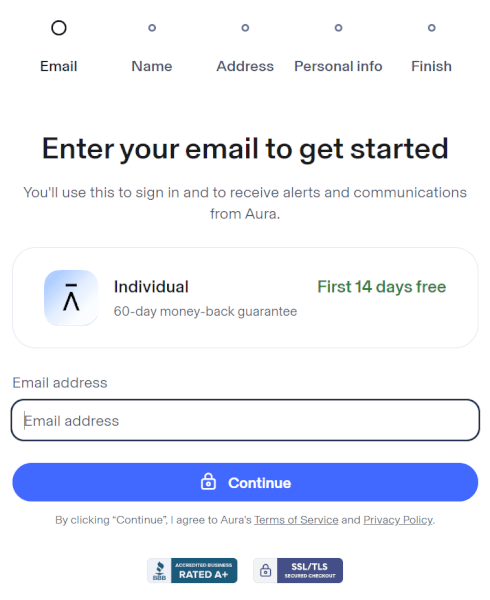

To sign up for Aura Identity Theft Protection, navigate to Aura’s official website and select a subscription. Here, you’ll be prompted to provide your name, email, phone number, and create a strong password.

After filling in these details, click the “Sign Up” button to complete the process, and voilà – you’ve just created your new Aura account.

Setting up Aura’s service is easy. The user interface is straightforward, offering quick access to features like VPN and antivirus. Separate downloads for features like Safe Gaming keep setup uncomplicated. Aura’s browser extensions enhance security with tools like password management and ad blocking.

The interface of Aura Identity Theft Protection has been thoughtfully refined for user ease, providing a streamlined signup and registration. Users report that the signup process is uncomplicated and quick, requiring just a few straightforward steps to start taking advantage of Aura’s services.

Testing out Aura’s desktop app

The Aura desktop app centralizes all of Aura’s security features in a streamlined interface. It keeps you updated on your credit score, recent transactions, and the status of your personal information.

You can customize the dashboard to highlight the most relevant information to you, like social media activities, financial account statuses, or the security of personal identifiers such as Social Security and credit card numbers. This customization makes the app a vital part of maintaining your digital security with ease.

Aura mobile app

For on-the-go users, Aura’s mobile app excels in accessibility. Compatible with iOS and Android, it caters to a broad mobile audience.

Its sleek interface simplifies protection management, facilitating smooth account access and financial account linking for vigilant monitoring. The app enables effective Aura account management and personal information protection directly from your smartphone.

Instant mobile notifications keep you promptly informed of any security concerns, ensuring you stay protected wherever you are.

However, in our testing we found that Aura’s multiple apps, while offering specialized security functions, could complicate the user experience compared to other services that consolidate features into one app.

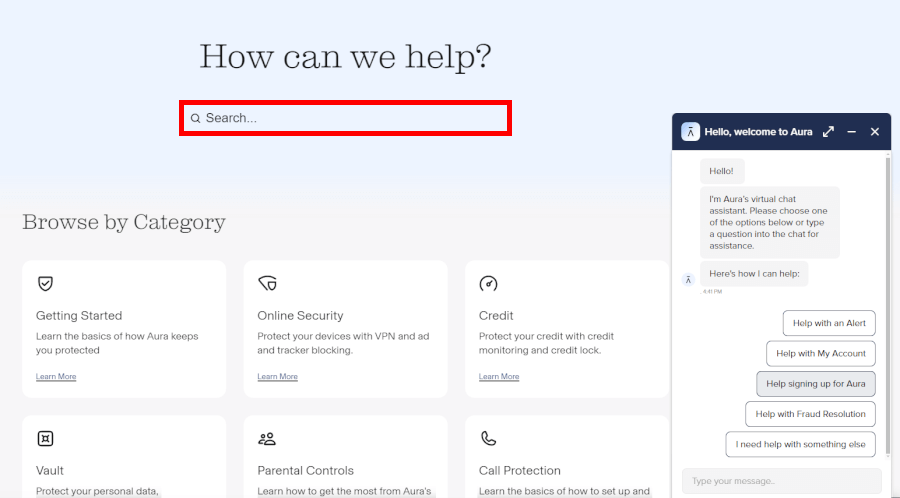

Customer support: What sort of help do you get with Aura?

Aura’s customer support shines brightly, offering 24/7 US-based assistance every day of the year to tackle any issues or queries you may have. With a seasoned team whose experience averages over seven years, you can be sure that you’re receiving expert help with every call. In the unfortunate event of identity theft, Aura’s dedicated, US-based fraud resolution specialists are ready to step in, providing clear guidance and support to ease the recovery process.

Whether you prefer reaching out by phone at +1 833-552-2123, by email at support@aura.com, or engaging in live chat during business hours, Aura offers a range of contact methods to suit your preference.

For the self-sufficient user, a rich repository of self-help documents and articles is at your disposal, allowing you to resolve simpler issues on your own or to learn more about the service at your leisure.

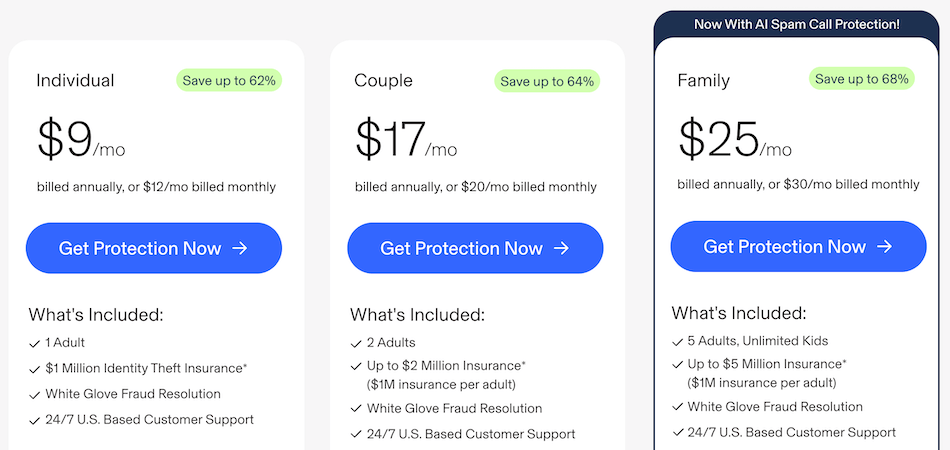

Plans and pricing: Is Aura worth your money?

Aura offers three well-structured plans for identity theft protection, each designed to cater to different needs.

- Individual Plan: This plan is perfect for single users, priced at

$12 monthly($9/mo. with coupon) when billed annually. It encompasses $1 million in identity theft insurance, 1GB of secure cloud storage in the Vault, and comprehensive security for up to 10 devices. - Couple Plan: Ideal for two users, this plan is available at

$22 per month($17/mo. with coupon) with annual billing. It includes the same $1 million insurance coverage for identity theft, doubles the cloud storage to 2GB, and extends device security coverage to 20 devices. - Family Plan: Designed with families in mind, this plan is priced at

$37 per month($25/mo. with coupon) when billed annually. It significantly increases the insurance coverage to $1 million per adult, provides a generous 5GB of cloud storage space, and secures up to 50 devices.

If safeguarding your children is your main concern, Aura’s “Kids” plan is tailored for you. This unique plan offers parental controls powered by Circle, ensuring safe browsing and time management across all devices for an unlimited number of children. However, it’s important to note that unlike other plans, the “Kids” plan does not include standard identity theft protection.

Each Aura identity theft protection plan includes $1 million in identity theft insurance per person and 24/7 US-based customer support. There’s also a 60-day money-back guarantee for annual subscriptions, ensuring satisfaction and peace of mind.

Aura’s pricing, while higher than some competitors, encompasses a comprehensive suite of security products within a single subscription.

How to get started with Aura: A quick guide

If you’re ready to enhance your digital security with Aura, here’s a straightforward guide to get you started:

- Select a plan: Visit Aura’s official website and choose the subscription plan that aligns with your security needs.

- Register with email: Start the registration process by providing your email address.

- Input your details: Fill in your name and address to set up your account.

- Complete your profile: Add the necessary personal details, including your payment information and Social Security Number (SSN), to complete your profile.

Verify and sign up: Review the information you’ve provided, make sure everything is accurate, and finalize the signup process.

Install the app: Download and install the Aura app on your device of choice and begin configuring your security settings.

By following these steps, you’ll be well on your way to securing your online presence with Aura.

Aura alternatives: How does Aura compare to competitors?

Let’s dive into a side-by-side comparison and see how Aura stacks up against the competition, keeping an eye out for the nitty-gritty details that make all the difference.

Exploring the world of identity protection, Aura and LifeLock both offer a robust set of features. Aura stands out with its budget-friendly plans that bundle antivirus and VPN services at no additional cost. While LifeLock’s certain plans boast up to $3 million in insurance coverage, Aura offers a solid $1 million coverage per adult for all its plans, which depending on the plan can be up to $5 million coverage. Despite some privacy concerns due to third-party data sharing, both services provide user-friendly interfaces on web and mobile platforms, catering to a variety of devices. (See our LifeLock review for more info).

Also check out our Aura vs LifeLock comparison to see how these two stack up to each other.

Meanwhile, Zander offers identity protection plans that are wallet-friendly, starting at $6.75/month for individuals and $12.90/month for families, complete with child protection features. However, Zander’s financial account monitoring isn’t as exhaustive as Aura’s. Additionally, Zander’s most comprehensive package, priced at $11.99/month for individuals and $21.99/month for families, lacks some of the advanced digital security features found in Aura’s offerings, which include extensive identity monitoring and robust security tools.

At the same time, when comparing Aura with IDShield, we find both services equipped with a wide array of features for all-around protection. IDShield is particularly noted for its reputation management services. Aura, on the other hand, impresses with its powerful toolkit for identity theft protection. Both Aura and IDShield shine as leading options in the identity protection arena.

See our IDShield review for more info and also our Aura vs IDShield comparison.

Other identity theft protection reviews on RestorePrivacy:

- Experian IdentityWorks Review

- IDShield Review

- LifeLock Review

- McAfee Review

- IdentityIQ Review

- Identity Guard Review

Aura FAQ

Is it safe to give my SSN to Aura?

Yes, providing your SSN to Aura is a secure choice. This plan offers top-tier identity theft protection, vigilant credit monitoring, and robust online security tools. Aura boasts a solid reputation, with over 25 million members served and a clean record of no data breaches, ensuring your information is in safe hands.

How does Aura protect against identity theft?

Aura helps protect against identity theft by using real-time monitoring of credit and identity, dark web scanning, three-bureau credit monitoring, and bank and investment account monitoring, as well as additional protection features. With these measures in place, Aura offers a comprehensive defense against identity theft.

What extra security features does Aura provide?

To comprehensively protect your online activities, Aura delivers a secure VPN service, a robust password manager, advanced ad and tracker blocking, top-notch antivirus software, and for those on the Family plan, thoughtful parental controls. These instruments collaborate seamlessly to fortify the security of your online existence. You can also find a discussion about Aura coupons on Reddit.

Conclusion: Is Aura worth the cost?

To wrap it up, Aura stands as a strong contender for comprehensive digital protection in 2024, with a user-friendly interface and plans tailored for different user needs. It offers vigilant real-time alerts, extensive monitoring services, and 24/7 customer support.

Aura’s robust security features, such as VPN, antivirus, and password manager, are commendable, and it delivers these features at an affordable price.

Aura provides a valuable service for those seeking a proactive approach to safeguarding their digital life, balancing its offerings with the challenges of modern online security.

This Aura Identity Theft Protection review was last updated on July 23, 2024.

My experience with Aura.

AURA’s Transparent & Straightforward Pricing

A trial of the Ultimate Individual Plan led me to believe I’d have 1 Adult coverage in

-Online & Device Security – 10 Devices

-Premium Identity Theft Protection

-$1M Identity Theft Insurance*

-Financial Fraud Protection

-White Glove Fraud Remediation

-Privacy Assistant

-Vault (1GB)

And thats true for the most part.

What I find, Aura is not giving a transparent pricing to being fully covered by Aura’s ID protection suite. (No feature differences across plan types. Every Aura member gets the same high level of protection.) So why is SCP extra?

Spam Call Protection is an ADD-ON cost on this Ultimate Individual plan.

Then looking over the nearly 600 digital-security-101 articles, you will find at lest two links saving you upto 50% and another for upto 75% off all of AURAs annual plans. Having the best price from the get-go with Aura is not easily transparent.

AURA seems to be a filtering approach to know everything about you and wants your premission to your accounts to warn you with near-real time alerts in the blanket suite of protection it offers.

I question this protection as a full suite of powerful digital security tools from one app:

VPN – being one US server without a dedicated client to any granular control and those facts. That only gives you the use options of Sheilds (everyday use) or VPN (temporarily use). Not your tipical VPN experience.

No warnings about, your phones device’s Location Services may be the reason some website’s know your location. You can enable location services through your phone. This process doesn’t rely on the internet, which might be masked by the VPN: instead, it operates through the cell phone tower. The Aura VPN here is primarily to mask IP addresses and to be used when connected to public Wi-Fi to keep you safe.

Aura Password Manager is available for iOS, Android, and with the browser extensions: Chrome, FireFox, and Edge. That is secured with 256-AES (Advanced Encryption Standard) to your Aura Vault area.

AURA’s Vault is your digital lockbox. Aura’s Vault helps you store important digital assets and passwords securely and easily share them with people on your plan.

Note: easily share your vault with people on your plan, in fact just accessing your Aura account, your Vault area is then unlocked. Shoot my foot, how is this even considered a digital lockbox?

When there is no security once you login to your Aura account for the Vault’s lockbox containing your personal information kept there?

Without installing the Aura desktop or mobile app the VPN, Anti-tracking and Password Manager features are not usable. Both latter mentions rely on browser extensions. Extensions being like new apps, which are third-party that you add to your device and provides another potential gateway into your other device’s and linked accounts like AURA is offering here…

Aura needs extensions for your online privacy by blocking intrusive site trackers that collect information on you and your browsing activity.

Available only on Chrome, Firefox, and Edge

Aura’s team of White Glove Fraud Resolution Specialists can walk you through the recovery steps and even facilitate three-way calls with your bank or government agencies. What Aura’s resolution specialists will do for you isn’t outlined to what is your actual part of envolvement that’s needed. A remediation plan with a hand-hold throughout the process until the issue is fixed. Sounds like lots of my own leg-work in the fraud recovery plan.

I called about Aura’s scan of my personal property records having said I had more than 20 vehicles titled, their rep responded, that I needed to call my States County office, so that was the end of AURA’s help.

The Identity Fraud Expense Reimbursement benefit is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company, under a group policy issued to Aura for the benefit of its Members and its affiliate company Members. To obtain a complete copy of the Policy as issued to Aura, contact Aura at 1 866 237-5240 American Bankers Insurance Company of Florida administers all claims and ****Aura shall have no responsibility to Members with respect to the Identity Fraud Expense Reimbursement benefit.****

Aura and Identity Guard are independent brands under the parent company Aura Sub, LLC.

While monitoring and fraud alerts are valuable ways to protect your identity, they don’t do anything you can’t do on your own.

This before post (HISTORY) was in relationship to the reviews features overview point below.

Experian CreditLock – Allows users to lock their Experian credit report to prevent unauthorized access (exclusive to Experian).

HISTORY

The company has its origins in Credit Data Corporation, a business which was acquired by TRW Inc. in 1968, and subsequently renamed TRW Information Systems and Services Inc.

In November 1996, TRW sold the unit, as Experian, to Bain Capital and Thomas H. Lee Partners. Just one month later, the two firms sold Experian to The Great Universal Stores Limited in Manchester, England, a retail conglomerate with millions of customers paying for goods on credit (later renamed GUS). GUS merged its own credit-information business, CCN, which at the time was the largest credit-service company in the UK, into Experian.

In October 2006, Experian was demerged from GUS and listed on the London Stock Exchange.

In August 2005, Experian accepted a settlement with the Federal Trade Commission (FTC) over charges that Experian had violated a previous settlement with the FTC. The FTC alleged that ads for the “free credit report” did not adequately disclose that Experian customers would automatically be enrolled in Experian’s $79.95 credit-monitoring program.

In January 2008, Experian announced that it would cut more than 200 jobs at its Nottingham office.

Experian shut down its Canadian operations on 14 April 2009.

In March 2017, the U.S. Consumer Financial Protection Bureau fined Experian $3 million for providing invalid credit scores to consumers.

In October 2017, Experian acquired Clarity Services, a credit bureau specialising in alternative consumer data.

Experian heavily markets its for-profit credit reporting service, FreeCreditReport.com, and all three agencies have been criticised and even sued for selling credit reports that can be obtained at no cost.

Experian also sells decision analytic and marketing assistance to businesses, including individual fingerprinting and targeting.

Experian is a partner in USPS address validation.

Total Asscets – FY2023/ US $10.864 billion

[https://www.experianplc.com/content/dam/marketing/global/plc/en/assets/documents/results-and-presentations/2023/experian-full-year-fy23-results.pdf]

Noticed this ***

Keep Your Texts Safe & Spam-Free

Aura protects you from harmful text messages by filtering out known spam numbers and scanning links in the message for phishing threats. Harmful messages will be placed in your junk folder.

* * *Available only for iOS* * *

Yes Aura offers a lot !

Missing though I find no service/support for these.

A. Masked Credit Card is a feature that allows you to create disposable credit card numbers to use instead of your personal credit card information.

B. (Something like this is a Spam Call & Message Protection – Family Plan only or as an add-on) see above * * *iOS only.

Masked Phone Number is a feature that allows you to create disposable phone numbers to use instead of your personal phone number. By using a Masked Phone Number instead of your personal phone number when signing up for services or apps, you can keep your personal phone number private and reduce the risk of receiving unwanted calls or text messages.

C. Redaction Help, images and floor plans are frequently available on real estate websites, even after a sale is finalized with a new home owner. The information stored on websites such as Zillow can be redacted so that detailed images of the layout/floor plan are unavailable for the general public to view. *If the property listing shows google street views you will have to make a request to remove images of the property through Google.

Very cool features indeed!

Yes I added those A-C in hopes AURA spyed reviews/comments online to see how they are received.

As a don’t STOP now on improving AURA.

It’s been so long since I used Abine Blur for something like this they’ve renamed it.

[https://ironvest.com/personal/]

I paid 99. then and see that’s not changed.

AURA,s VPN Product Privacy Notice, doesen’t name the VPN being used as well.

[https://www.aura.com/privacy/vpn-products]

Thought this helpful –

VPN Security

Our VPN servers are hosted with infrastructure providers that do not require us to collect any information about what our users are doing via a VPN connection. If any such provider were to require us to collect such information, we would stop doing business with them and find an alternative provider.

Our VPN servers are monitored using a state-of-art intrusion detection system backed by a 24×7 security operations center.

Welcome Sead = )

Glad to see – “Aura’s pricing, while higher than some competitors, encompasses a comprehensive suite of security products within a single subscription.” – is noted in the review.

The VPN that’s mentioned is so un-named WHO?

Is it simular to a compaines or businesses VPN in-house execution?

I’ve had Lifelock for a year, but as I remember, I quit it for the second year. Because to renew raised by 50% higher from my initial years cost.

There is a link to save with Aura upto 75% off all plans. I won’t post it but its Aura own I believe.